Universal Life Insurance Problems

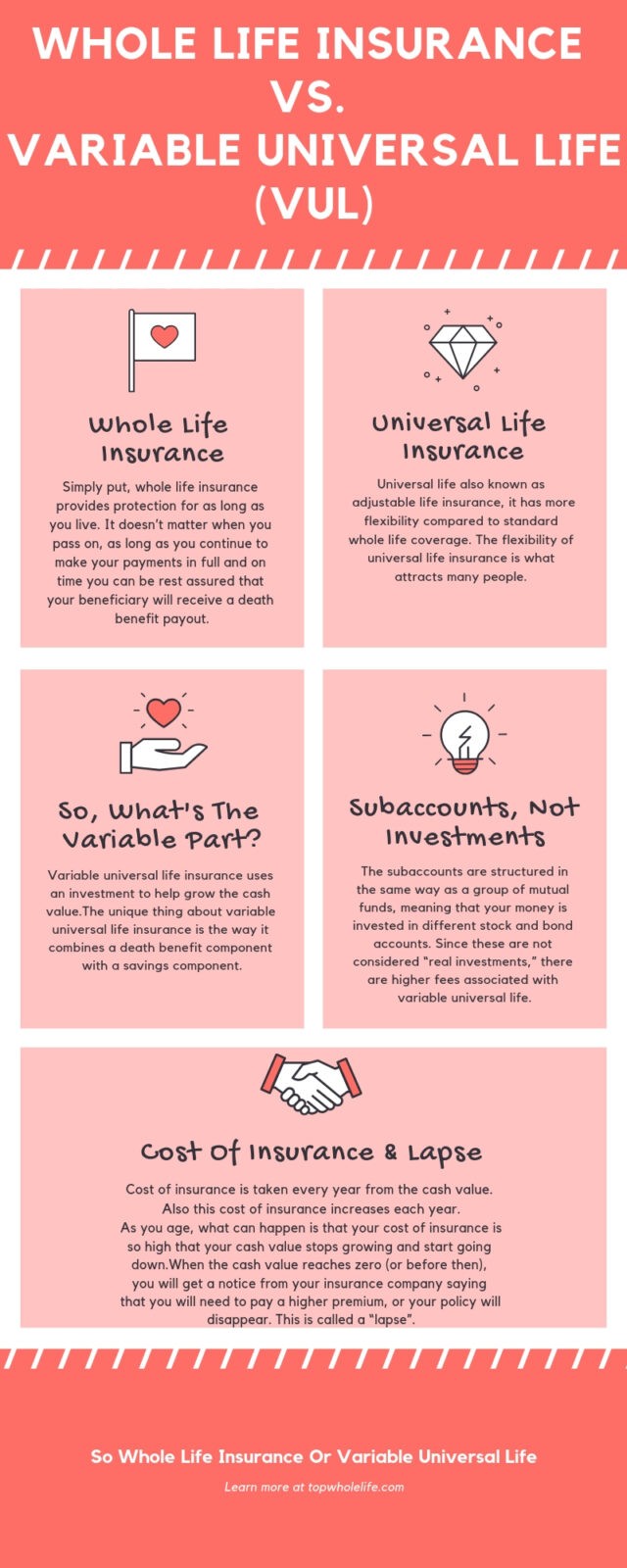

Universal life is a form of permanent life insurance designed to be more affordable than traditional whole life insurance. The primary differences are that the cash value for whole life insurance policies grows at a guaranteed interest rate and premiums are level for the life of the policy.

5 Disadvantages Of Indexed Universal Life Insurance Know Your Options

5 Disadvantages Of Indexed Universal Life Insurance Know Your Options

This can be both an advantage as well as a disadvantage when compared to universal life insurance.

Universal life insurance problems. The cost of insurance in a variable universal life policy is so high that inadequate growth of the cash value will result in increased premiums. Even if your income is fixed you can choose to pay a low premium fee if the market is down and switch to a high premium when the market is in its peak. Featuring financial experts and economists as well as testimonies of actu.

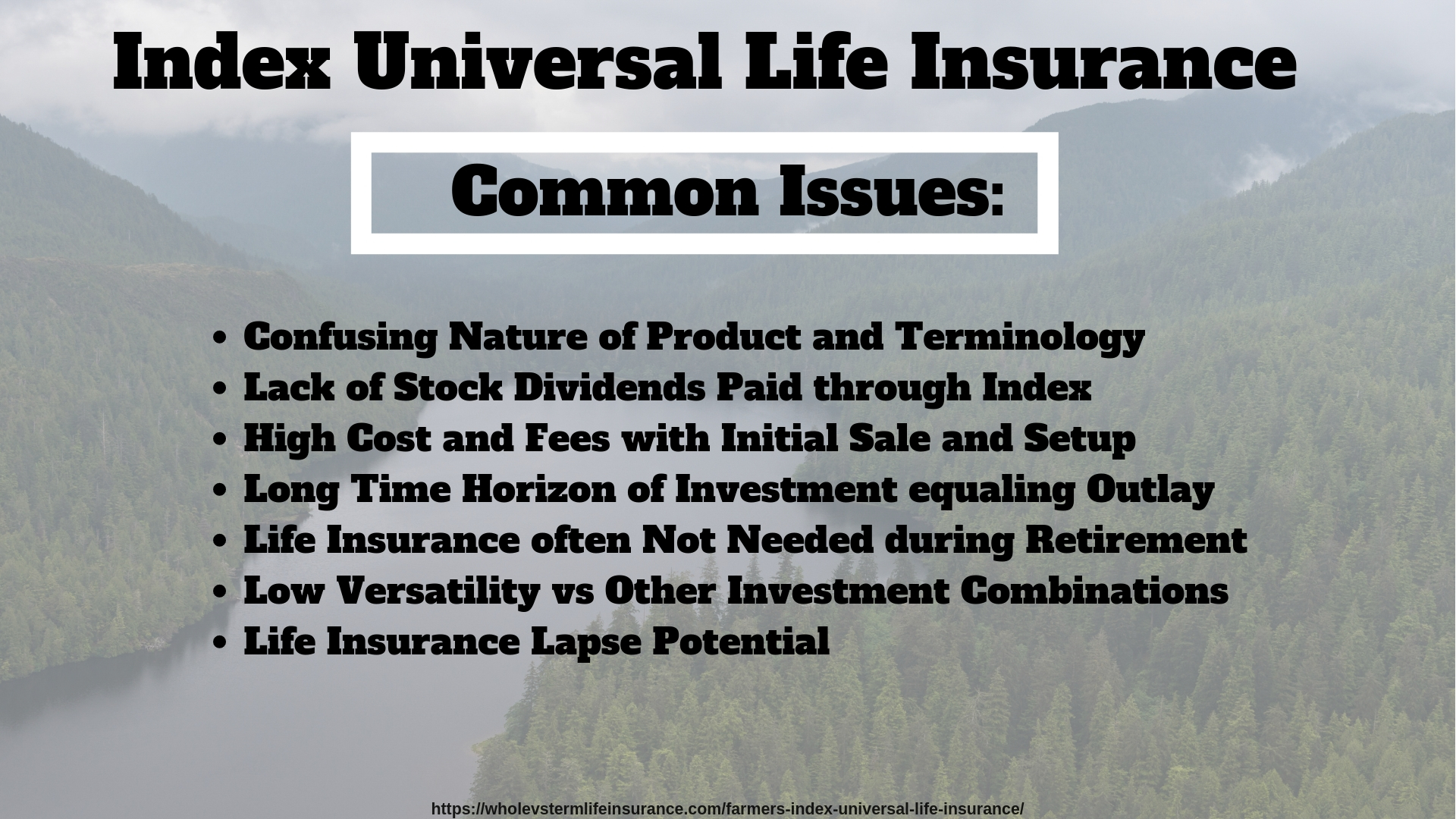

Having an FIUL insurance policy can present the following disadvantages. This is called financial independence. Universal life insurance wont end after a specific number of years.

But before we discuss potential solutions lets look at what caused the problem in order to understand what options you have now. Universal life insurance is famous for its flexible policy. Difficulty understanding how the policy works because its an advanced type of life insurance.

However did you know that in the first 10-15 years of a universal life policy if they wish to access their own money in that account they must pay a fee called the surrender charge. Dealing with more risk than you would with a fixed universal life policy. 5 Reasons Why Buying Indexed Universal Life Insurance is a Bad Idea 1.

Universal life insurance comes with incredible flexibility but that flexibility also comes with certain consequences that can cause problems for those who dont treat it correctly. This problem appeared because of sustained reduced interest rates and inattention on the part of the owners who didnt. Not having any interest credited to cash value if the index goes down.

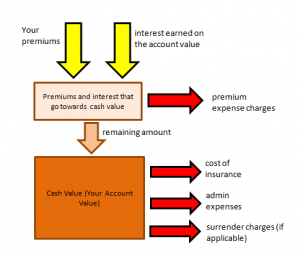

The hope is that the policyholder will receive a higher-year-old on their cash value than they would in an ordinary universal life insurance policy without being subject to the downside risks of a variable universal life insurance policy. Collected premiums in excess of the cost of UL insurance accumulate within the cash value portion of the policy. If you dont have a fixed income I think there is no better life insurance policy for you than a universal life.

Summary Yes there is a serious problem. This is probably one of the biggest reasons why individuals looking for permanent life insurance will choose an IUL over a Whole Life insurance policy. Banking With Life is a documentary that covers a lot of material in under an hour.

Depending on which policy you choose you can vary your premiums death benefit coverage length and cash value growth. Is Universal Life Insurance Really a Ripoff. The short answer is no.

The vast majority of Americans and especially high-income Americans like physicians will at some point no longer depend on their earnings from work in order to live. Access to Universal Life Insurance Investment Account Extremely Limited Policy owners will build up their investment accounts over a period of time. Universal life insurance is not a ripoff but it had better make sense for what youre trying to accomplish.

Universal life insurance is some of the most flexible coverage you can buy. For example Ive seen these type of policies used for estate planning purposes to pass more onto the heirs of clients. You dont need a permanent death benefit.

The Indexed Universal Life insurance policy has serious upside growth potential. Over time the cost of insurance will increase as the insured ages. Indexed universal life insurance appears to be the third generation of hybrid life insurance products designed to appeal Insurance consumers.

Many non-guaranteed universal life insurance policies are expiring prematurely. When a variable universal life policy isnt adequately funded from the outset a low return on invested premiums will hasten the policys failure. If youre in that situation you do have choices but they involve trade-offs.

Universal life insurance does have a lot of great features to offer the right type of insurance buyer.

Top 12 Pros And Cons Of Indexed Universal Life Iul Insurance

Top 12 Pros And Cons Of Indexed Universal Life Iul Insurance

What Is Guaranteed Universal Life Insurance And How Does It Work

What Is Guaranteed Universal Life Insurance And How Does It Work

The Risks Of Cash Value Life Insurance

The Risks Of Cash Value Life Insurance

The Disadvantages Of Universal Life Regulators Issue A Warning

The Disadvantages Of Universal Life Regulators Issue A Warning

Gf 031 Is Universal Life Insurance A Ripoff Good Financial Cents

Gf 031 Is Universal Life Insurance A Ripoff Good Financial Cents

Cost Of Universal Life Insurance Stings Retirees Wsj

Cost Of Universal Life Insurance Stings Retirees Wsj

What Is Universal Life Insurance

What Is Universal Life Insurance

Universal Life Time Bomb Myth The Insurance Pro Blog

Universal Life Time Bomb Myth The Insurance Pro Blog

Farmers Index Universal Life Insurance Whole Vs Term Life

Farmers Index Universal Life Insurance Whole Vs Term Life

Non Guaranteed Vs Guaranteed Universal Life Insurance The Basics

Non Guaranteed Vs Guaranteed Universal Life Insurance The Basics

Problems With Universal Life Insurance Woody S Insurance

Problems With Universal Life Insurance Woody S Insurance

Selling Universal Life How To Use The Fabulous New Instrument Of Life Insurance To Solve Personal And Business Problems Webb John F 9780878632237 Amazon Com Books

Selling Universal Life How To Use The Fabulous New Instrument Of Life Insurance To Solve Personal And Business Problems Webb John F 9780878632237 Amazon Com Books

Whole Life Insurance Vs Variable Universal Life Vul Risky Or Safe

Whole Life Insurance Vs Variable Universal Life Vul Risky Or Safe

Some Universal Life Policyholders Facing Big Premium Increases

Some Universal Life Policyholders Facing Big Premium Increases

Comments

Post a Comment