What Is Morningstar Risk Rating

To receive a Morningstar Rating a fund must have a record of more than three years. The Morningstar Rating is a measure of a funds risk-adjusted return relative to similar funds.

:max_bytes(150000):strip_icc()/FourStars-a5c749f029884577a687e3fcf960863c.jpg) Morningstar Risk Rating Definition

Morningstar Risk Rating Definition

On a scale of one to five stars a Morningstar rating measures investments based on backward-looking data.

What is morningstar risk rating. The key word here is historical and as Morningstar points out a funds past performance should not be projected to persist in future time periods. A mutual fund with average risk receives a Morningstar risk rating of 1. The Morningstar risk rating is Morningstars evaluation of a mutual fund s level of risk.

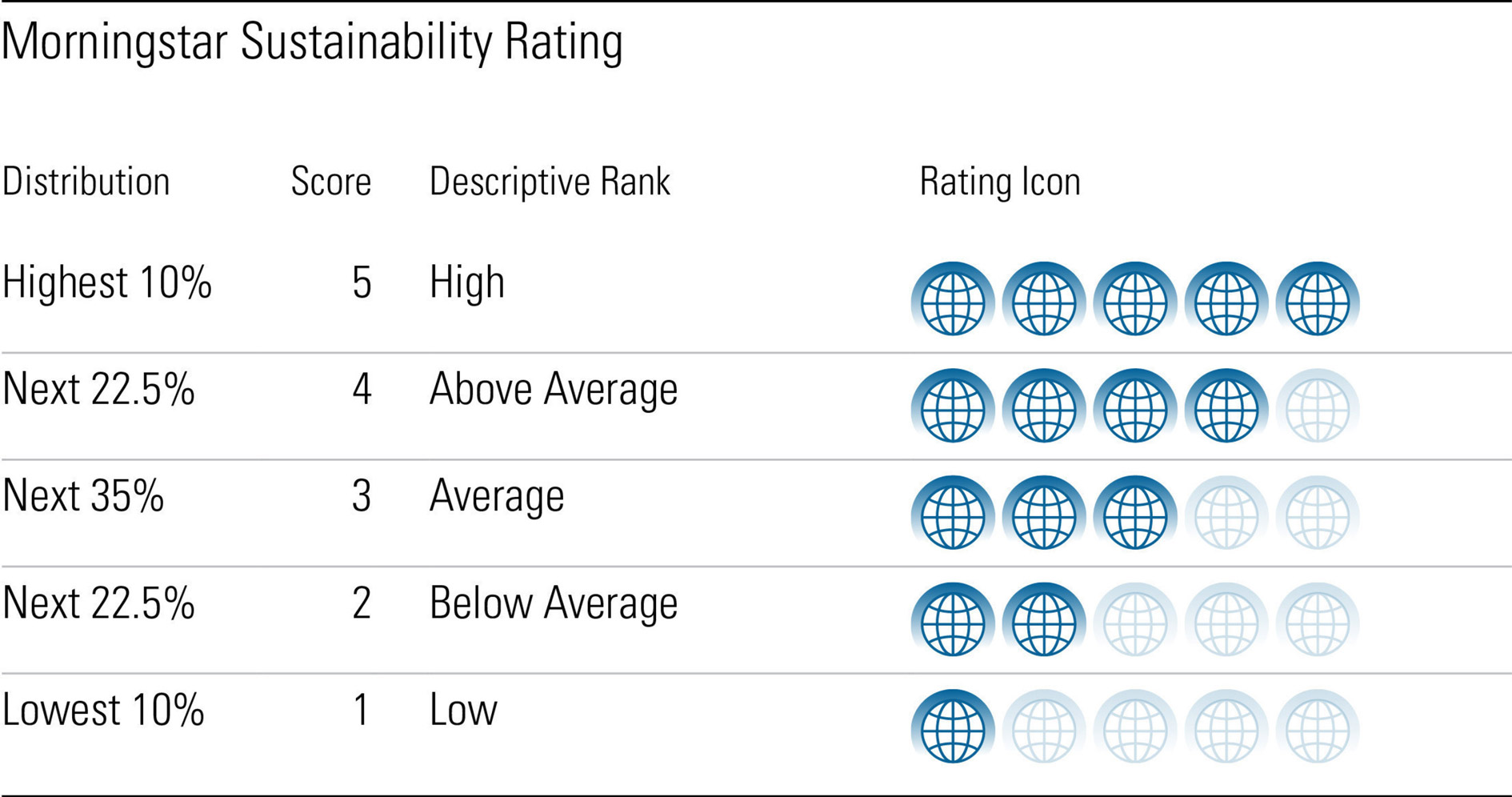

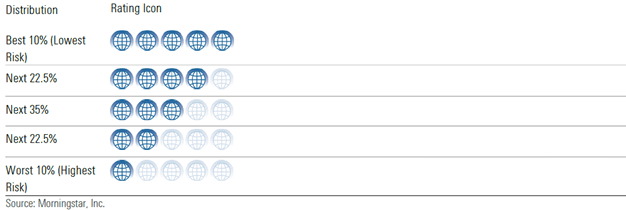

The Morningstar Sustainability Rating is a measure of how well the holdings in a portfolio are managing their environmental social and governance or ESG risks. For example it may compare the volatility of a bond fund to other bond funds. The Morningstar Rating for investments commonly called the star rating is a measure of an investments risk-adjusted return relative to similar investments.

How Does a Morningstar Risk Rating Work. The Morningstar risk rating also known as the Morningstar rating or the star rating is a position or score that is given to publicly traded ETFs exchange-traded funds or mutual funds. The peer group for each funds rating is its Morningstar Category.

Investments are rated from one to. On a scale of one to. Funds are rated from 1 to 5 stars with the best performers receiving 5 stars and the worst.

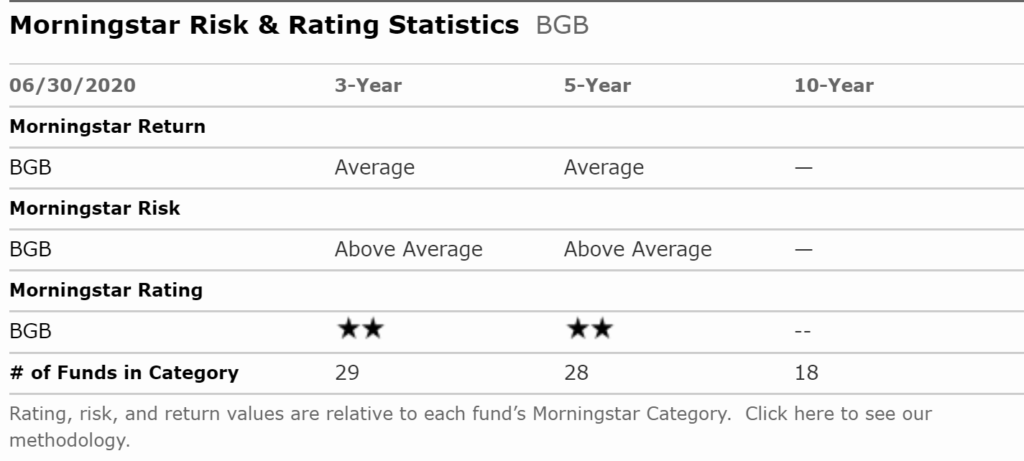

The Morningstar risk rating is a ranking given by research firm Morningstar to publicly traded mutual funds and exchange-traded funds ETFs. Morningstar Risk Rating An annualized measure of a funds downside volatility over a three- five- or ten-year period. The Morningstar Rating has the following key characteristics.

Morningstar Risk Morningstar Risk score describes the variation in a funds month-to-month returns. Find and examine the rating for your stock which is based on a combination of the stocks current market value and what Morningstar feels is a fair market value. This rating is a comparative measure against the yield of the T-bill and examines the frequency of a funds losses.

Ratings are based on funds risk-adjusted returns. Morningstar Risk Rating A measure of a mutual funds risk compared to other similar mutual funds. The mutual fund ratings agency Morningstar ascribes a risk rating to each fund it covers.

Morningstar rates mutual funds from one to five stars based on how well theyve performed after adjusting for risk and accounting for sales charges in comparison to similar funds. The Morningstar Rating methodology rates funds within the same Morningstar Category based on an enhanced Morningstar Risk-Adjusted Return measure. Ratings for stocks are adjusted for risk.

This is a component of the Morningstar Risk-Adjusted Return. Within each Morningstar Category the top 10 of funds receive five stars and the bottom 10 receive one star. Morningstar assigns the Analyst Rating to funds that analysts qualitatively assess.

Morningstar ratings are a system for evaluating the strength of an investment based on how it has performed in the past. But unlike standard deviation which treats upside and downside variability equally the risk. Morningstar ratings provide a snapshot of a funds historical risk-adjusted performance.

The Morningstar Rating is a risk-adjusted cost-adjusted comparison of fund performance within fund categories. The Morningstar Sustainability Rating is a reliable and objective way for investors to see how approximately 20000 mutual funds and exchange-traded funds. To help investors and enable them to identify potential portfolio additions Morningstar assesses risk across five different levels to produce the rating.

Morningstar Ratings Morningstar Rating. For a star rating Morningstar looks at all the funds in the same Morningstar Category and rates the fund based on their enhanced Morningstar Risk-Adjusted Return measure The rating is assessing the track record of the fund compared to its peers and will only rate a fund if it has a track record of at least three years. The more stars the better a fund or stocks historic returns.

Morningstar Risk Rating Overview How It Works And Rating Periods

Morningstar Risk Rating Overview How It Works And Rating Periods

Introducing The Enhanced Morningstar Analyst Rating For Funds Morningstar

Introducing The Enhanced Morningstar Analyst Rating For Funds Morningstar

How To Read A Morningstar Report Pathfinder Planning

How To Read A Morningstar Report Pathfinder Planning

Morningstar Sustainability Rating For Funds

Morningstar Sustainability Rating For Funds

Morningstar Ratings Useful Or Useless

Morningstar Ratings Useful Or Useless

Morningstar Star Rating Explainer What They Are How To Use Them

Morningstar Star Rating Explainer What They Are How To Use Them

Enhancement To Sustainability Rating Emphasizes Material Esg Risk Morningstar

Enhancement To Sustainability Rating Emphasizes Material Esg Risk Morningstar

/business-man-placing-wooden-block-on-a-tower-concept-risk-control--planning-and-strategy-in-business-alternative-risk-concept-risk-to-make-buiness-growth-concept-with-wooden-blocks-1194847491-565039719222432f8bd7247a41867c6d.jpg) Morningstar Risk Rating Definition

Morningstar Risk Rating Definition

How To Decode Risk And Return Measures Morningstar

How To Decode Risk And Return Measures Morningstar

Morningstar Ratings Morningstar Com Au

Morningstar Ratings Morningstar Com Au

Help Understanding Morningstar Ratings Willis Owen

Help Understanding Morningstar Ratings Willis Owen

Morningstar Star Rating Explainer What They Are How To Use Them

Morningstar Star Rating Explainer What They Are How To Use Them

What Is Morningstar Sustainability Rating Rl360

What Is Morningstar Sustainability Rating Rl360

Comments

Post a Comment