Indiana College Choice 529

We last updated the Indianas CollegeChoice 529 Education Savings Plan Credit in January 2021 so this is the latest version of Form IN-529 fully updated for tax year 2020. Terms and conditions apply to the Upromise service.

The Benefits Of The Indiana College Choice 529 Plan Pittman Legal Tax Advisors

The Benefits Of The Indiana College Choice 529 Plan Pittman Legal Tax Advisors

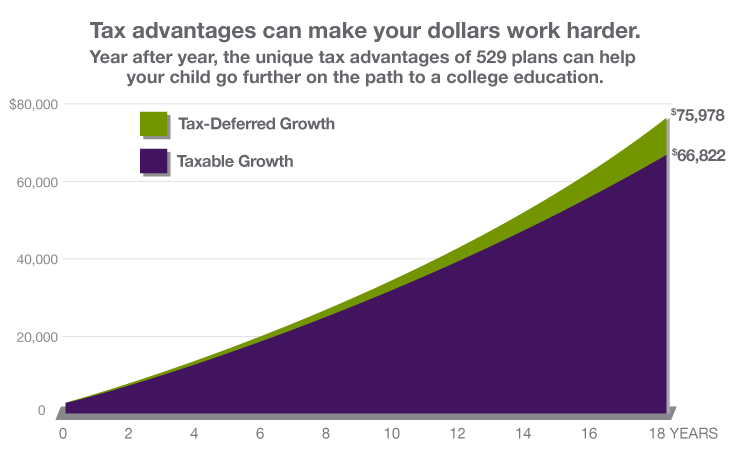

CollegeChoice Advisor is designed to help individuals and families save for college in a tax-advantaged way and offers valuable advantages including tax-deferred growth generous contribution limits attractive investment options and.

Indiana college choice 529. CollegeChoice 529 Direct Savings Plan PO. The CollegeChoice 529 Direct and the CollegeChoice Advisor. An Section IRC Section 529 plan is a program under whicha person may make cash contributions to an account on behalf of a beneficiary for payment of qualified higher education expenses.

However we frequently get questions regarding who can use the funds. The plan also offers investment portfolios with relatively low fees. Indiana 529 Tax Benefit.

Ascensus Broker Dealer Services LLC ABD is. You can then contribute up to 450000one of the highest contribution maximums weve seen in the country. Read and consider it carefully before investing.

An Indiana CollegeChoice 529 Education Savings Plan is a reference to a plan established by Indiana pursuant to 529 of the Internal Revenue Code IRC. CollegeChoice Advisor is a Section 529 plan offered by the Indiana Education Savings Authority and managed by Ascensus Broker Dealer Services LLC. Indiana 529 College Savings Plans.

Box 219418 Kansas City MO 64121 For overnight delivery or registered mail send to. Participating companies contribution levels and terms and conditions are subject to change at any time without notice. The benefits of being an Indiana resident.

Upromise is an optional service offered by Upromise Inc is separate from the CollegeChoice Advisor 529 Savings Plan and is not affiliated with the State of Indiana. You can download or print current or past-year PDFs of Form IN-529 directly from TaxFormFinder. CollegeChoice 529 is administered by the Indiana Education Savings Authority Authority.

Upromise Investments Inc serves as the program manager and Upromise Investment Advisors LLC provides investment advisory recordkeeping and administrative services. CollegeChoice 529 Direct Savings Plan is administered by the Indiana Education Savings Authority. The program allows Hoosiers to plan for their.

Indiana CollegeChoice 529 Plan. The Indiana CollegeChoice 529 Plan is the name of Indianas traditional investment-based 529 Plan. In September 2008 Upromise Investments Inc which was acquired by Ascensus College Savings in 2013 took over the management of the Indiana CollegeChoice 529 Direct Savings Plan from JPMorgan and it now features a year of enrollment option using Vanguard index and Loomis Sayles funds seven individual portfolios using a variety of investment managers and an FDIC-insured savings account.

ABD the Program Manager and its affiliates have overall responsibility for the day-to-day operations including investment advisory recordkeeping and administrative services and marketing. YOU MAY HAVE OTHER RIGHTS OR POWERS UNDER INDIANA LAW NOT SPECIFIED IN THIS FORM. College Choice the Indiana 529 plan is a great way to save for college expenses.

For more information about the CollegeChoice Advisor 529 Savings Plan CollegeChoice Advisor contact your financial advisor call 18664859413 click here to obtain a Disclosure Statement which includes investment objectives risks charges expenses and other important information. Two of the three Indiana 529 college savings programs are managed by Ascensus College Savings. For more information about the CollegeChoice Advisor 529 Savings Plan CollegeChoice Advisor contact your financial advisor call 18664859413 click here to obtain a Disclosure Statement which includes investment objectives risks charges expenses and other important information.

And whether out-of-state schools are included. This plan offers a variety of investment options including age-based portfolios that become more conservative as the child approaches college. Indianas CollegeChoice 529 Direct Savings Plan allows you to invest in your childs future with as little as a 10 deposit.

Read and consider it carefully before investing. CollegeChoice 529 Direct Savings Plan 920 Main Street Suite 900 Kansas City MO 64105. The newest Indiana 529 plan is the CollegeChoice CD which offers FDIC-insured savings options.

CollegeChoice Advisor is Indianas tax-advantaged 529 savings plan designed to help people easily and affordably save for college. Return this form and any other required documents to. About 529 Plans General Info About 529 Plans.

College Choice 529 Investment Plan.

Indiana Collegechoice 529 Plan Here S Why We Love It Club Thrifty

Indiana Collegechoice 529 Plan Here S Why We Love It Club Thrifty

Frequently Asked Questions Collegechoice 529

Frequently Asked Questions Collegechoice 529

Https Forms In Gov Download Aspx Id 2854

Indiana 529 Plan And College Savings Options Collegechoice 529

Indiana 529 Plan And College Savings Options Collegechoice 529

Indiana Collegechoice 529 Plan Here S Why We Love It Club Thrifty

Indiana Collegechoice 529 Plan Here S Why We Love It Club Thrifty

Indiana In 529 College Savings Plans Saving For College

Indiana In 529 College Savings Plans Saving For College

Top 529 Myths Collegechoice 529

Top 529 Myths Collegechoice 529

Indiana S Collegechoice 529 Education Savings Plan Credit

Indiana S Collegechoice 529 Education Savings Plan Credit

Collegechoice Advisor 529 Savings Plan Home

Collegechoice Advisor 529 Savings Plan Home

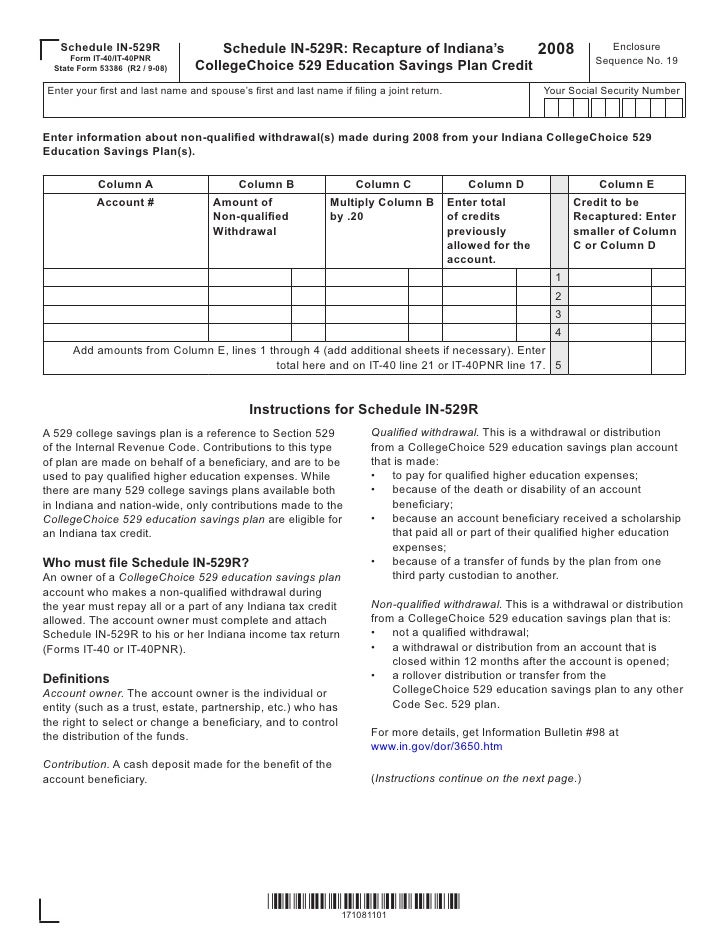

Recapture Of Indiana S Collegechoice 529 Education Savings Plan Cred

Recapture Of Indiana S Collegechoice 529 Education Savings Plan Cred

Manage Accounts Collegechoice 529

Manage Accounts Collegechoice 529

Comments

Post a Comment