Discover Interest Rate Student Loans

Compare Discovers range of interest rates with other private student loan lenders. For variable interest rate loans the 3-Month LIBOR is 0250 as of January 1 2021.

:max_bytes(150000):strip_icc()/discover-3aa7e52b2d454e6a9abcfc0fa38aa483.png) Discover Student Loans Review 2021

Discover Student Loans Review 2021

Our rewards include cash back and may even reduce your interest rate if you are eligible.

Discover interest rate student loans. Your actual rate will depend on factors including your or your co-signers credit history and financial. The variable interest rate is calculated based on the 3-Month LIBOR index plus the applicable margin percentage. Discover Student Loans Rewards.

Graduate or Professional Unsubsidized loans 43. 9 lignes Discover offers both variable- and fixed-rate options across its student loan products. To highlight the value of paying off your loan sooner imagine you had 25000 in student loan debt at an interest rate of 8 over a 20 year term.

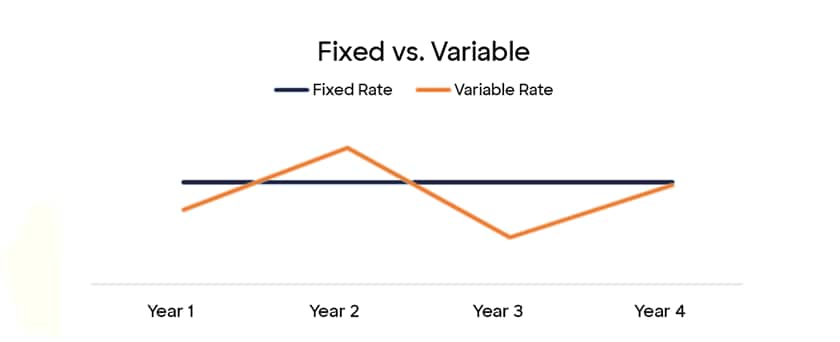

And theres no annual fee. Discover student loan consolidation will repay existing student loans of your choice with a new student loan which can give you the chance to secure lower interest rates and simplify repayment. The fixed interest rate is set at the time of application and does not change during the life of the loan.

While you are making your interest-only payments you will be eligible to receive a 035 interest rate reduction. For example on a 10000 undergraduate loan with a fixed 649 percent interest rate in-school deferment for 45 months a 6-month grace period and 15-year term your monthly payment could be 11105 and you would pay 9989 in interest over the loans lifetime. If you sign up for automatic withdrawals for your minimum monthly payment Discover will reduce your interest rate by 025.

If all your interest is paid prior to entering repayment you will retain the interest rate reduction for the life of the loan. If you cut the term in half to 10 years it would cost you an extra 9645 per month but save you 1168285 in extra interest payments over the life of. For the budget-conscious student a fixed loan can feature a higher starting APR.

Compared to last year students will be paying 178 less on interest which could save you hundreds to thousands of dollars over the life of the loan. If you agree to make interest-only payments while in. Then 1299 to 2199 Standard Variable Purchase APR will apply.

You can refinance up to 150000 in student loans though Discover may refinance moreup to the full balancefor specific fields of study. The student Discover card starts at 0 intro APR for 6 months on purchases. On top of this it gives a 1 cash reward to students who maintain a 30 GPA while theyre using a Discover student loan to pay for school.

Discover Student Loans may adjust the rate quarterly on each January 1 April 1 July 1 and October 1 the interest rate change date based on the 3-Month LIBOR Index published in the Money Rates section of the Wall Street Journal 15 days prior to the interest rate change date rounded up to the nearest one-eighth of one percent 0125 or 000125. Direct PLUS loans 53. The interest rate ranges represent the lowest and highest interest rates offered on Discover student loans including Graduate Health Professions Law and MBA Loans.

The interest rate ranges represent the lowest and highest interest rates offered on the Discover Undergraduate Loan. Find out more about our student loan. If you are applying for a Bar Exam or Residency loan you must be enrolled in school at least half-time at the time you submit your application to be eligible for the interest-only repayment option and discount.

You will receive an interest rate discount 035 if during the application process you selected the interest-only repayment option and make interest-only payments during the in-school and grace periods. For example the Discover undergraduate student loan has a starting APR of 474 on a fixed-rate loan and a maximum rate of 1279 as of November 2019. Learn more about the added benefits of a Discover student loan and how to make the most of money-saving rewards on your student loans.

The fixed interest rate is set at the time of application and does not change during the life of the loan. The variable interest rate is calculated based on the 3-Month LIBOR index plus the applicable Margin percentage. This may cause the monthly payments to increase.

Income Contingent Student Loans for pre-2012 Plan 1 loans From 1 September 2020 until 31 August 2021 the maximum interest rate that can be set for the existing Income Contingent Repayment Loans. Ascents non-cosigned student loan option features a variable interest rate ranging from 331 to 1262. Undergraduate Direct Subsidized and Unsubsidized loans 275.

Discover offers a 025 discount on interest to borrowers who sign up for autopay. Youll first need to have an undergraduate graduate law health professions or MBA loan to qualify. These monthly payments mean less interest accruing each month during your in-school and grace periods.

Undergraduate Student Loans Discover Student Loans

Undergraduate Student Loans Discover Student Loans

What You Should Know About Student Loan Interest Rates Student Loan Hero

What You Should Know About Student Loan Interest Rates Student Loan Hero

Discover Personal Loans 2021 Review Nerdwallet

College Credit Card Discover It Student Chrome Discover

College Credit Card Discover It Student Chrome Discover

Discover Student Loans Review A Good Option For Private Student Loans

Discover Student Loans Review A Good Option For Private Student Loans

Understanding Student Loan Interest Rates Discover Student Loans

Understanding Student Loan Interest Rates Discover Student Loans

Discover Student Loans 2021 Review Bankrate

Discover Student Loans 2021 Review Bankrate

Graduate School Student Loans Discover Student Loans

Graduate School Student Loans Discover Student Loans

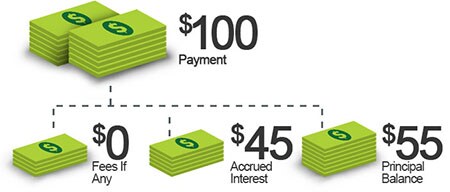

How Payments Are Applied Discover Student Loans

How Payments Are Applied Discover Student Loans

Student Loans For College Discover Student Loans

Student Loans For College Discover Student Loans

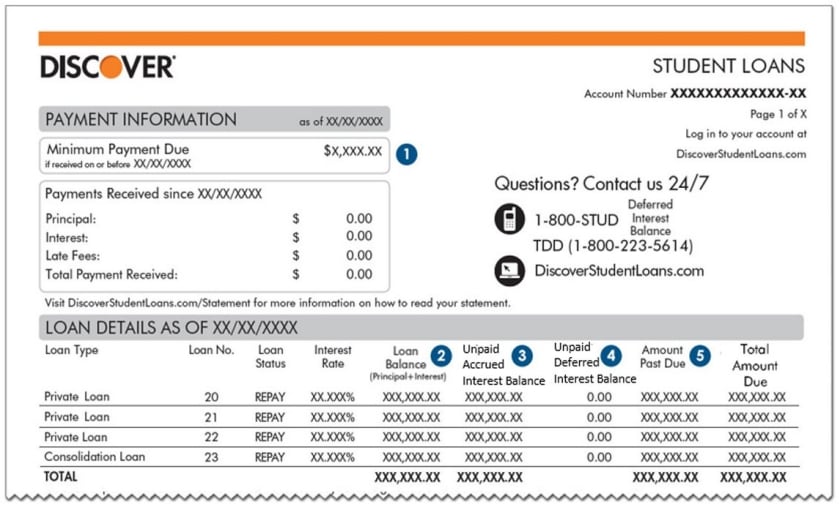

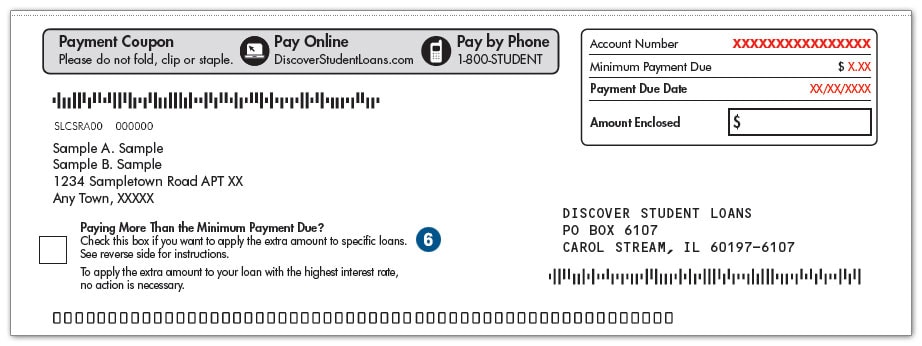

Statement And Payments Discover Student Loans

Statement And Payments Discover Student Loans

Discover Slashes Student Loans

Discover Slashes Student Loans

Statement And Payments Discover Student Loans

Statement And Payments Discover Student Loans

Https Www Discover Com Content Dam Dfs Student Loans Pdf App Solicit Disclosure Parent Pdf

Comments

Post a Comment