How To Estimate Health Care Costs In Retirement

Fidelity began measuring retirement health care costs in 2002. Planning for retirement includes planning for the costs associated with health care coverage.

How Much Will You Spend In Retirement Fidelity

How Much Will You Spend In Retirement Fidelity

For single retirees the estimate is 150000 for women and 135000 for men according to Fidelity.

How to estimate health care costs in retirement. As part of our advice service youll receive a retirement plan that includes a personalized health care estimate for every year youre in retirement taking into account your health status coverage choices retirement location and more. In The Lifetime Medical Spending of Retirees report the economists determined that people incur an average of 122000 in medical costs between. Use this tool to help you predict your costs over the coming years.

Because of the effects of inflation a 50-year-old couple in 2019 planning to retire at age 65 can expect to spend about 405000 on health care in retirement. You can include your spouse too. So there you have it.

However even without the same rate of growth some retirees are still surprised by todays cost of. The average couple retiring in 2019 at age 65 will need 285000 to cover health care and medical costs in retirement according to an annual estimate by Fidelity released today. You do not need to be an AARP member.

After totaling those costs you estimate that your total expenses in retirement will be 4150 per month which is 49800 per year. 1 This could represent more than they have allotted for housing and recreation in retirement. Since that first estimate of 160000 costs have risen a total of 88.

The AARP Health Care Costs Calculator is an educational tool designed to estimate your health care costs in retirement. A 65-year-old woman typically could expect to. Read Planning for healthcare costs in retirement.

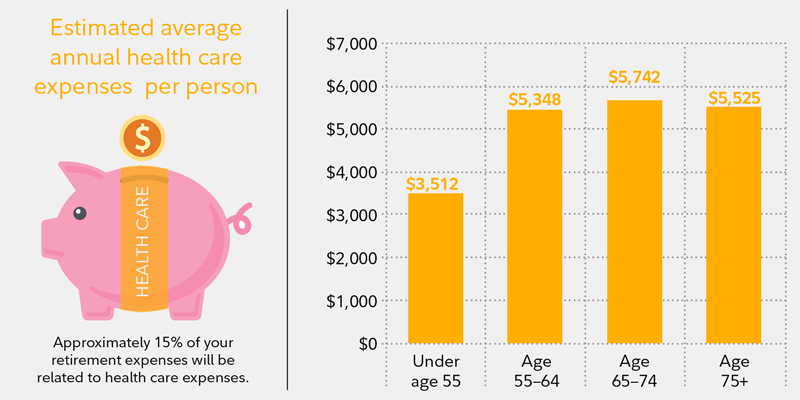

And Fidelity says the average 65-year-old couple will spend around 11400 on healthcare in the first year of retirement. Its also likely that these healthcare costs will rise at about double the rate of inflation which means ten years into retirement that 375 a month can be closer to 675 a month using a 6 inflation rate. One of the biggest expenses that retirees face is health care costs.

That cuts out 1000 per month from your spending. For single retirees the health care cost estimate is 150000 for women and 135000 for men. Many people approaching retirement think Medicare is free and theyre blindsided about the actual costs.

But what you will spend on health care costs in retirement could be less or potentially a lot more. The average retiree spends around 4300 per year on out-of-pocket healthcare costs according to a study from the Center for Retirement Research at. Fidelity notes that the past two years combined have seen a slower rise 36 than in the previous two 2015 to 2017 which saw the estimate grow to 275000 from 245000 up a total of 122.

That means if you havent put about 375 a month into your budget for health care costs youre going to find yourself short on cash. Find your magic number now. See how we can help.

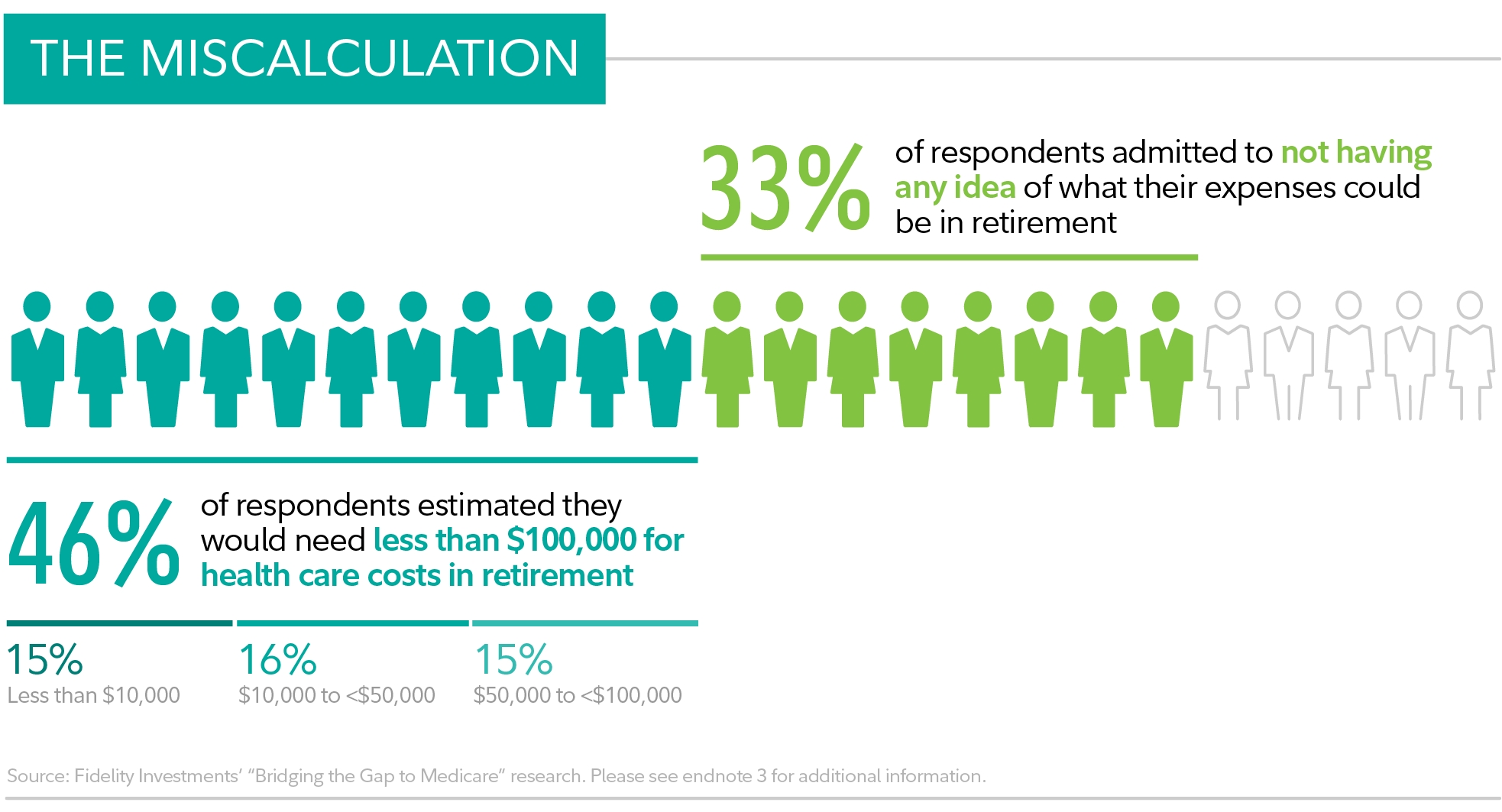

Knowing the truth can help you prepare. Research conducted in 2018 shows some couples could need as much as 400000 for health and medical care expenses alone up from 317000 in 2017. Understanding these numbers is half of the battle experts say.

Each year Fidelity releases its annual Retiree Health Care Cost Estimate and this year it states that the average 65-year-old couple retiring in 2020 can. This cannot be done without taking into consideration Medicare costs. Multiply that amount by how many years you expect to live in retirement and youll have a good starting target for your retirement accounts.

According to a 2018 Fidelity Investments 16 th annual retiree health care cost estimate a 65-year-old couple who retired.

A Couple Retiring In 2018 Would Need An Estimated 280 000 To Cover Health Care Costs In Retirement Fidelity Analysis Shows Business Wire

A Couple Retiring In 2018 Would Need An Estimated 280 000 To Cover Health Care Costs In Retirement Fidelity Analysis Shows Business Wire

How To Plan For Rising Health Care Costs Fidelity

How To Plan For Rising Health Care Costs Fidelity

Retiree Health Care Costs Rise Again

Retiree Health Care Costs Rise Again

Health Care Price Check A Couple Retiring Today Needs 285 000 As Medical Expenses In Retirement Remain Relatively Steady

Health Care Price Check A Couple Retiring Today Needs 285 000 As Medical Expenses In Retirement Remain Relatively Steady

Planning Healthcare Costs In Retirement Freemedsuppquotes

Healthy You Ll Spend More On Health Care In Retirement Wsj

Healthy You Ll Spend More On Health Care In Retirement Wsj

How To Calculate Health Care Expenses In Retirement Bautis Financial

How To Calculate Health Care Expenses In Retirement Bautis Financial

How To Calculate Health Care Expenses In Retirement Bautis Financial

How To Calculate Health Care Expenses In Retirement Bautis Financial

Estimating Health Care Costs In Retirement D Y Wealth Advisors

Estimating Health Care Costs In Retirement D Y Wealth Advisors

A Couple Retiring In 2018 Would Need An Estimated 280 000 To Cover Health Care Costs In Retirement Fidelity Analysis Shows Business Wire

A Couple Retiring In 2018 Would Need An Estimated 280 000 To Cover Health Care Costs In Retirement Fidelity Analysis Shows Business Wire

The Real Ly Manageable Cost Of Health Care In Retirement

The Real Ly Manageable Cost Of Health Care In Retirement

Fidelity S 20th Annual Retiree Health Care Cost Estimate Hits New High A Couple Retiring Today Will Need 300 000 To Cover Medical Expenses An 88 Increase Since 2002 Business Wire

Fidelity S 20th Annual Retiree Health Care Cost Estimate Hits New High A Couple Retiring Today Will Need 300 000 To Cover Medical Expenses An 88 Increase Since 2002 Business Wire

The Real Cost Of Health Care In Retirement Barron S

The Real Cost Of Health Care In Retirement Barron S

The Real Ly Manageable Cost Of Health Care In Retirement

The Real Ly Manageable Cost Of Health Care In Retirement

Comments

Post a Comment