Chase Loan Origination Fee

It covers the service they provide during the loan approval process. While each lenders estimates for third-party fees can be adjusted by shopping for individual services costs like the origination fee and tax servicing fees.

Chase Personal Loans Compare Alternatives Lendedu

Chase Personal Loans Compare Alternatives Lendedu

If a lender takes a 2-percent fee for originating a loan for example the lenders will make 600 on a 30000 loan.

Chase loan origination fee. Chase earns 4 of 5 stars on this factor. An origination fee is a one-time cost your lender subtracts from the top of whatever amount they lend you to pay for administration and processing costs. Chases low origination fee represents big savings in an area that borrowers dont have much control over.

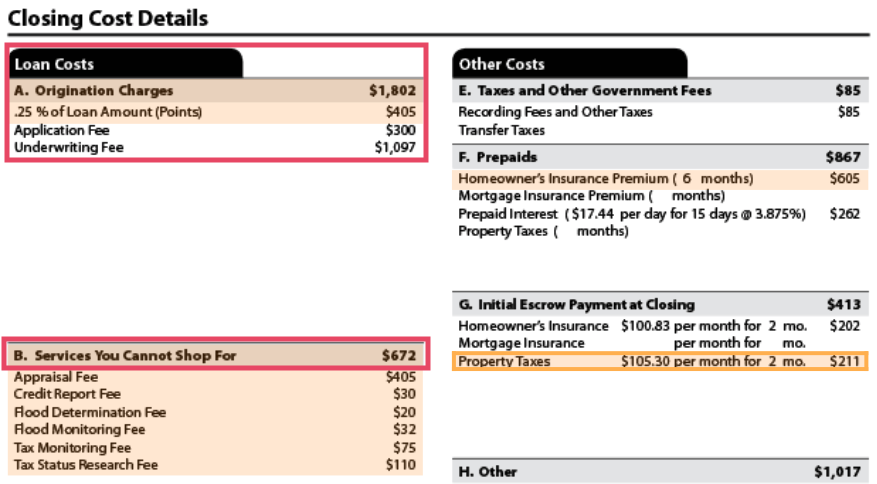

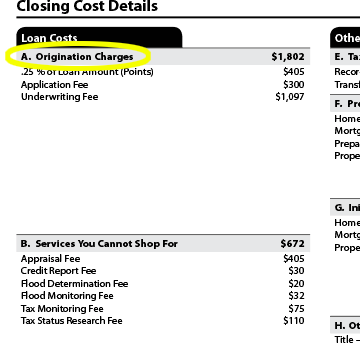

Its based on your loan amount property location and rates found in your agreement. The Closing Disclosure is five pages and the top of page two also has a section called Origination Charges making it easy to confirm whether the lender fees you were quoted on the Loan Estimate are the same before your loan closes. Origination fees are usually between 05 and 1 of the loan amount.

These fee savings apply to the full spectrum of residential mortgage types including. A loan origination fee is an upfront fee charged by your lender to process a new loan application. Attorney fees Covers legal representation to prepare and record documents.

Morgan Wealth Management accounts or waiver of the entire processing fee up to 1150 for most loans for 500000 in such eligible accounts. An origination fee is typically 05 to 1 of the loan amount and is charged by a lender as compensation for processing a loan application. Origination fee Covers loan processing and administration.

Underwriting feeCovers the cost of. An origination fee is a payment associated with the underwriting of a loan. What is an Origination Fee.

Factors determining the fee amount include your credit score the loan amount and repayment term and the information youve. The Loan Estimate is three pages and the top of page two has a section called Origination Charges which are the fees charged by the lender. 1 Chase Home Lending offers 500 off of the processing fee for Chase Private Clients with combined assets of 150000 - 499999 in eligible Chase deposit andor JP.

Interest rate price locks are a different thing. Most of these large institutions charge a flat fee of 1000 or more for their origination services although Chase charged a much lower 595. The fees are generally.

You should always look at the all-in cost of the loan. An origination fee is typically a set amount and is typically 0 5 of the loan amount. A loan origination fee is an upfront charge paid to the lender at closing.

This amount is listed on your monthly statement. Origination fee shouldnt change from the first loan estimate paperwork to the last. Origination fee should be 1 if theyre trying to bump it 4K theyre just being an ass hole.

Appraisal fee Covers the cost for the report that shows the estimate of the homes market value. A 20000 personal loan with a 5 origination fee 1000 for example can mean you get 19000 or an additional 1000 on the balance. Its a fixed cost.

While these lenders all used a flat fee for origination other lenders sometimes set this fee at 1 of the. Origination fees typically range from 1 to 10 of the loan amount. A complete list of your debts including student loans auto loans personal loans and credit cards Costs and fees In addition to a 395 application fee Chase also charges the following fees.

Lenders use these fees to offset the costs of underwriting and verifying a new borrower. Inflexible loan terms High origination fee of up to 8 Must have at least 1000 left over after monthly expenses Stricter eligibility criteria for self-employed applicants Loan Amount 1000 50000. Charged when a scheduled payment isnt received by the due date or end of the grace period.

Mortgage loans are a useful method to buy new homes especially. For leases the leasing origination fee is a flat fee. A lenders average origination fee compared to the median of all lenders reporting under the Home Mortgage Disclosure Act.

Read on to learn how you can negotiate the origination fee.

Mortgage Profits Lag Origination Gains At Wells Fargo Jpmorgan Chase National Mortgage News

Mortgage Profits Lag Origination Gains At Wells Fargo Jpmorgan Chase National Mortgage News

Loan Origination Fee Why Am I Paying It The Truth About Mortgage

Loan Origination Fee Why Am I Paying It The Truth About Mortgage

Chase Mortgage Review Smartasset Com

Chase Mortgage Review Smartasset Com

Compare The Best Mortgage Rates Top 24 Lenders Ranked

Compare The Best Mortgage Rates Top 24 Lenders Ranked

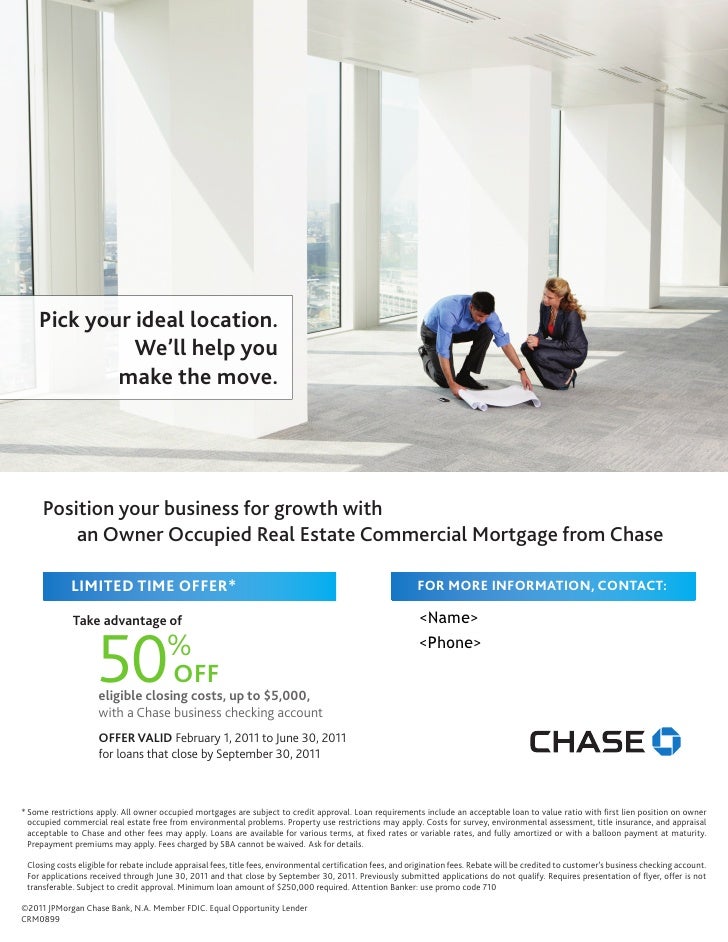

Take Advantage Of 50 Off Closing Costs

Take Advantage Of 50 Off Closing Costs

Chase Mortgage Review Lower More Transparent Fees Valuepenguin

Loan Origination Fee Why Am I Paying It The Truth About Mortgage

Loan Origination Fee Why Am I Paying It The Truth About Mortgage

What Is A Mortgage Origination Fee Nerdwallet

What Is A Mortgage Origination Fee Nerdwallet

What Are Discount Points And Origination Fees On A Loan Estimate Getloans Com

What Are Discount Points And Origination Fees On A Loan Estimate Getloans Com

Loan Origination Fee Why Am I Paying It The Truth About Mortgage

Loan Origination Fee Why Am I Paying It The Truth About Mortgage

Loan Origination Fee Why Am I Paying It The Truth About Mortgage

Loan Origination Fee Why Am I Paying It The Truth About Mortgage

Chase To Pay 50 Of Closing Costs

Chase To Pay 50 Of Closing Costs

Chase Bank Mortgage Review May 2021 Finder Com

Chase Bank Mortgage Review May 2021 Finder Com

Comments

Post a Comment