Dave Ramsey Fha Loan

Check out my free or purchasable resources for First Time Home Buyers below. These are designed for our more rural areas.

A conventional loan is not secured by a government agency making it a little trickier to qualify if you dont have a credit score.

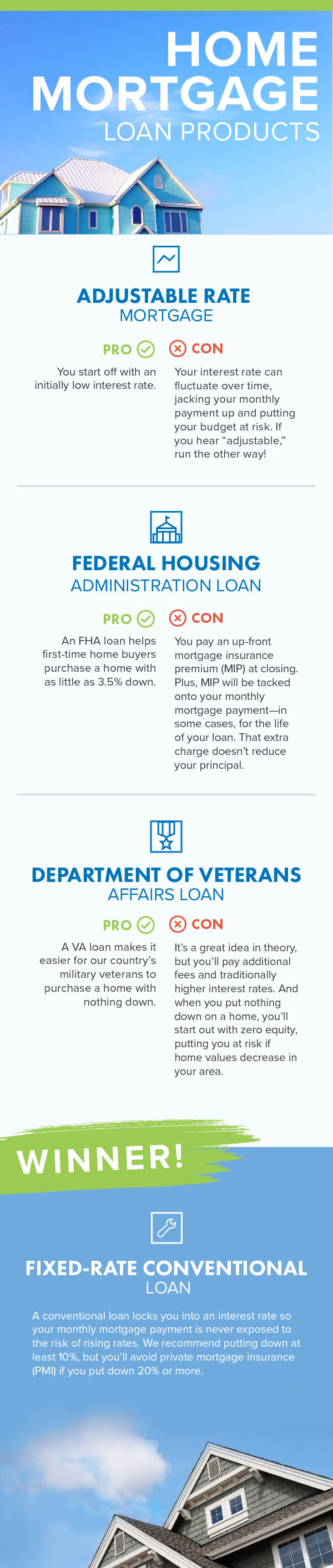

Dave ramsey fha loan. USDA loans have location restrictions and income restrictions. For example if youre not into mowing your own lawn or taking care of a back yard an FHA condo loan might be the best option for you instead of a standard FHA 203b loan for a typical suburban home. A VA home loan are one of the more expensive kinds of loans.

You pay an extra fee called mortgage insurance premium MIP when you take out an FHA loan. FHA loans are another popular mortgage option designed specifically for first-time home buyers. Dave Ramsey says that home equity loans are too risky because borrowers could end up losing their homes.

Plus these loans are backed by the government which means the government insures the bank so it wont lose its money if you dont make your payments. With a minimum down payment of just 35 on a 30-year loan at 375 interest your monthly payment would total 1031. They accept less of a down payment.

If I followed The Gospel According to Dave Id be debt-free after selling my first triplex in order to pay off more than 40000 in credit card and auto loan debt acquired as a result of a carefree youth. You can put down a smaller down payment with an FHA but youre going to pay a little bit more interest plus youre going to pay the MIP every time. Dave Ramsey recommends a 15-year fixed-rate conventional loan.

Cheaper closing costs 1. I had to tell someone I started watching Dave in high school but after a car loan and turning 20 somehow was 20000 in over my eyes with the car and credit cards. What To Do With Extra Money In The Bank.

Welcome to The Dave Ramsey Show like youve never seen it before. I thought an FHA loan would be a good fit because you only need 35 down. The dave ramsey show.

FHA loans are slightly more expensive interest rate-wise. Free Guides Mortgage Calculators HomeScout App Blog Articles. He also warns that home equity loans often have high interest rates variable interest rates and other forms of balloon payments that can make it hard for borrowers to make the payments.

Dave Ramsey gives some good common sense advice on buying a home but you may need to consider more than seven basic steps to determine your readiness for buying a house. Find out what Dave gets wrong and right when it comes to the debt consolidation loan. Youd also pay 3378 in upfront MIP at closing and 128774 in.

Save a good down payment instead of doing a VA mortgage. Reduced down payment requirements. In these uncertain economic times I can understand turning to financial experts for car buying advice and arguably one of the most famous is Dave Ramsey.

A Dave Ramsey billboard on the other side of the road. Its a veterans benefit but its not actually a benefit because you can get a conventional loan at less fees and lower interest rates. 888-562-6200 Loan Servicing Center Buy a Home Refinance.

An FHA loan is a type of loan from the Federal Housing Association for first-time buyers and for folks who might have a hard time getting approved for a conventional mortgage when buying a home. You Have a High Interest Rate Loan. They require 0 for a down payment and carry a smaller monthly mortgage insurance payment than the FHA loans.

An FHA home loan can make it easier for someone to own their first home. Like the FHA you can include up to 6 of the purchase price into the contract to cover the buyers closing costs. If you can find a loan that offers a drop of 12 in its interest rate you should think about it.

FHA loans make it easier for first-time buyers to make the leap to home ownership by requiring as little as 35 down. Youre required to keep the private mortgage insurance PMI for the full term of the loan. Thank you so much for taking some of your valuable time to watch my video.

For over 25 years Churchill Mortgage has been helping families find the smartest home loan for a new home purchase or refinance. The only advantage of the VA house loan is that you can put nothing down which I dont consider an advantage. If your mortgage has a higher interest rate compared to ones in the current market then refinancing could be a smart financial move if it lowers your interest rate or shortens your payment schedule.

What Is an FHA Loan. That includes 894 for principal and interest plus 137 for MIP each month. Dave Ramsey Review.

It only requires you to have 35 on hand for a down payment.

10 Dave Ramsey Approved Home Buying Tips

10 Dave Ramsey Approved Home Buying Tips

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2018 Fha V Conventional Loan Fha Loans Mortgage Loans

Kentucky Fha Loans Compared To Kentucky Conventional Loans Kentucky First Time Home Buyer Programs For 2018 Fha V Conventional Loan Fha Loans Mortgage Loans

Types Of Mortgages Which Is Right For You Ramseysolutions Com

Types Of Mortgages Which Is Right For You Ramseysolutions Com

What Is An Fha Loan Ramseysolutions Com

What Is An Fha Loan Ramseysolutions Com

Epingle Par Karijordannaberylecp Sur Mortgage Comment Savoir Hypotheque Dave Ramsey

Epingle Par Karijordannaberylecp Sur Mortgage Comment Savoir Hypotheque Dave Ramsey

Dave Ramsey Is Wrong About Va Loans Carlos Scarpero Va Mortgage Specialist Nmls 1674385

Dave Ramsey Is Wrong About Va Loans Carlos Scarpero Va Mortgage Specialist Nmls 1674385

Churchill Mortgage Review Dave Ramsey S Pick The Truth About Mortgage

Churchill Mortgage Review Dave Ramsey S Pick The Truth About Mortgage

Top 15 Mortgage Questions Answered Ramseysolutions Com

Top 15 Mortgage Questions Answered Ramseysolutions Com

What Dave Ramsey Doesn T Mention About How To Buy A House

What Dave Ramsey Doesn T Mention About How To Buy A House

Dave Ramsey Mortgage Advice Should You Buy A House With Student Loans Debt Free Doctor

Dave Ramsey Mortgage Advice Should You Buy A House With Student Loans Debt Free Doctor

What Is An Fha Loan Ramseysolutions Com

What Is An Fha Loan Ramseysolutions Com

Dave Ramsey Breaks Down The Different Types Of Mortgages Youtube

Dave Ramsey Breaks Down The Different Types Of Mortgages Youtube

Dave Ramsey Breaks Down The Different Types Of Mortgages Youtube

Dave Ramsey Breaks Down The Different Types Of Mortgages Youtube

Comments

Post a Comment