Vehicle Allowance Tax

The employee need not necessarily spend 575 per month on his car and would continue to receive that amount regardless. Is car allowance part of my salary.

2021 Everything You Need To Know About Car Allowances

2021 Everything You Need To Know About Car Allowances

The amount of tax you have to pay depends among others on the type of vehicle its weight type of fuel and its environmental impact.

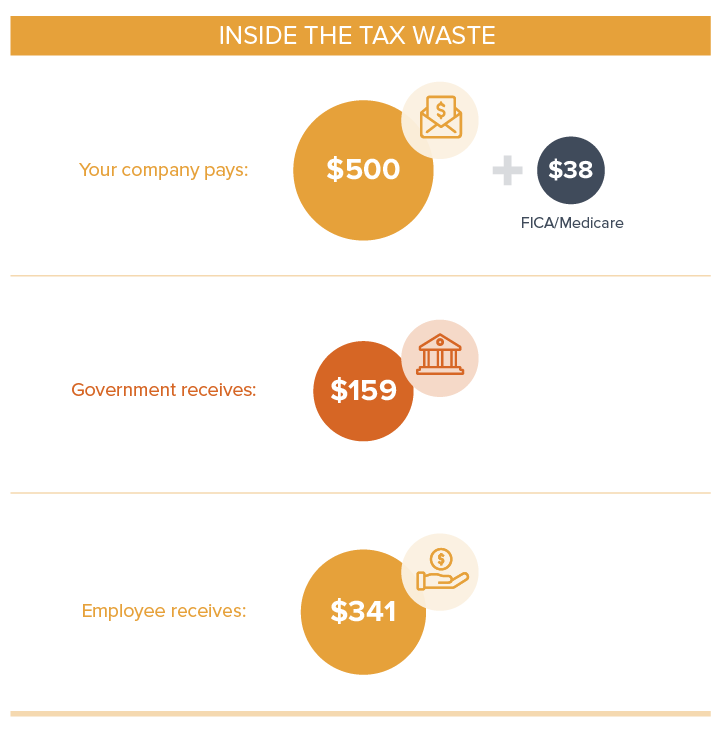

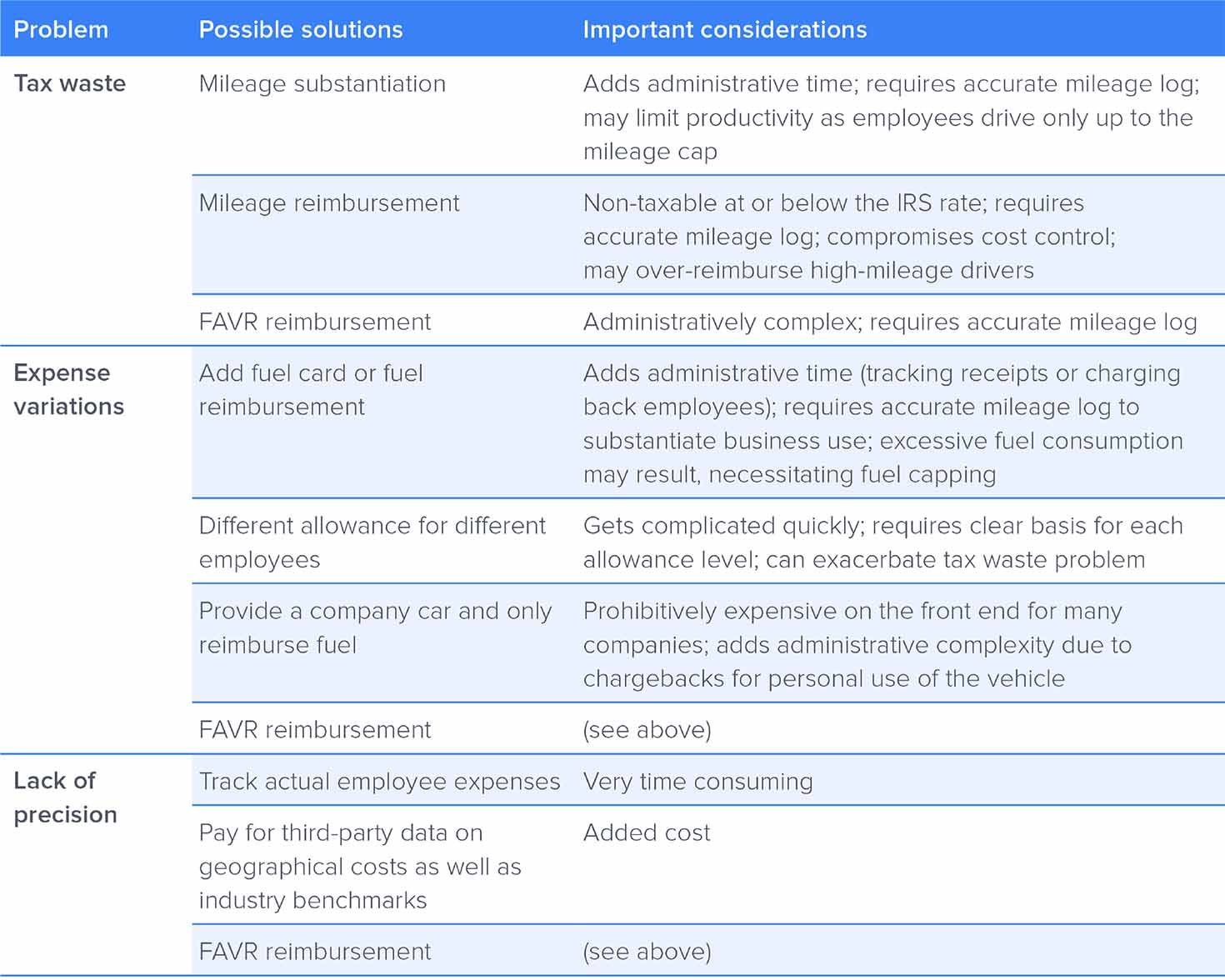

Vehicle allowance tax. Car allowances result in significant tax waste. What are the tax ramifications. You can use simplified.

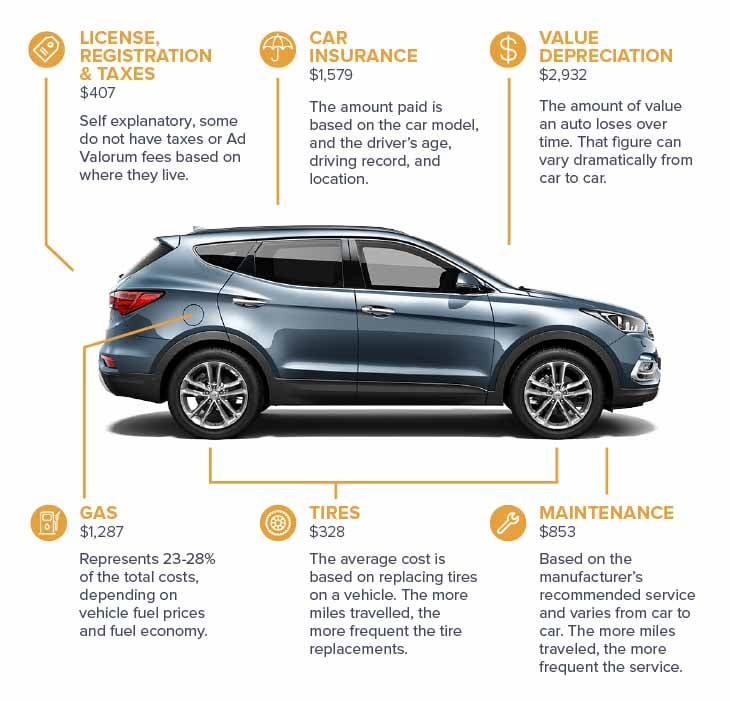

For lorries there is a special rate. An allowance is any payment that employees receive from an employer for using their own vehicle in connection with or in the course of their office or employment without having to account for its use. A typical car allowance may be reduced by 3040 after all these taxes.

Excess amounts are returned in a reasonable time. The allowance gets added to their annual earnings. A fixed monthly car allowance is considered compensation and therefore taxable income at both federal and state levels.

An accountable plan includes expense allowances that. Some employers go so far as to leave it up to the employees to address if they want their car allowance to be taxed on their W2 tax form. Remember if you use TaxTim to complete your tax return then he will do.

Its meant to cover the costs of using your own car. This payment is in addition to their salary or wages. Is a car allowance considered taxable income.

A car allowance is what an employer gives employees for the business use of their personal vehicle. This car expense allowance isnt subject to payroll tax as it was paid on a per kilometre basis. If youre deducting allowance from their annual earnings then this is incorrect.

A recent reminder V11 or last chance warning letter from DVLA. Your vehicle log book V5C - it must be in your name. Motor vehicle allowances paid on a per kilometre allowance Sally uses her personal motor vehicle for business purposes and receives an allowance of 60 cents per business kilometre.

Employees dont have to pay taxes on a car allowance if its a part of an accountable plan. With an accountable plan companies do not report car allowance. How Allowances are Different.

Motor vehicle allowances paid as a fixed amount with records. Both employee and employer must also pay FICAMedicare taxes on the allowance. Yes at your regular income tax rate.

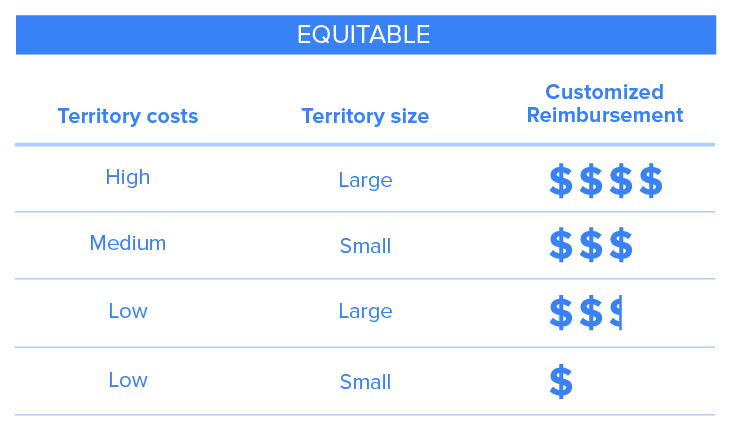

Some companies provide allowances or stipends based on an employees actual expenses. Hence it is essential to know. Ultimately car allowances create tax waste for both the employer and employee and decrease employee efficiency.

Other reimbursement methods can even be paid tax-free. A car allowance covers things like fuel wear-and-tear tires and more. It is important to remember that the expenditure being claimed may NOT exceed the motor vehicle allowance received for the tax year.

Also note that you will have to retain proof of all the expenses claimed and preferably submit this with your tax return so Inland Revenue can verify the expenses you are claiming. 17 Zeilen Taxability under option a- It will be taxed as a perquisite and the difference of. For example you might receive a stipend based on the actual mileage put on your car for wear and tear.

A car allowance is a set amount over a given time. An allowance is taxable unless it is based on a reasonable per-kilometre rate. Although companies can easily report car allowances to the IRS they raise a companys Federal Insurance Contributions Act FICA tax liability greatly.

Can I receive mileage allowance while receiving a car allowance. Do you get taxed on car allowance. Again this is another common employee question.

As a result that allowance is taxable income. Calculate your vehicle expenses using a flat rate for mileage instead of the actual costs of buying and running your vehicle for example insurance repairs servicing fuel. Tax your car motorcycle or other vehicle using a reference number from.

Claim capital allowances so your business pays less tax when you buy assets - equipment fixtures business cars plant and machinery annual investment allowance first year allowances. Your car allowance is paid out with your salary and it is taxed at the same rate as your monthly income. A company car not allowance tax generally incurs much higher tax costs than an allowance.

Are car allowances taxable. Most companies reimburse employees for miles traveled or get a flat-rate car allowance. Consequently the employer must ensure that the post-tax amount can cover an employees vehicle expenses not the pre-tax amount.

You can use the motor vehicle tax rate tool in Dutch to calculate the tax rate. Before 2018 employees could write off business mileage to offset these taxes. Although a car allowance is generally a great benefit one thing to consider is how much tax you will be paying if you do receive it as it can push you into a higher tax bracket.

.png) Is Car Allowance Taxable Under Irs Rules I T E Policy I

Is Car Allowance Taxable Under Irs Rules I T E Policy I

Company Cash Allowance Vs Company Car Vanarama

Company Cash Allowance Vs Company Car Vanarama

Why Is A Car Allowance Taxable What Sets This Vehicle Program Apart

Why Is A Car Allowance Taxable What Sets This Vehicle Program Apart

2021 Everything You Need To Know About Car Allowances

2021 Everything You Need To Know About Car Allowances

2021 Everything You Need To Know About Car Allowances

2021 Everything You Need To Know About Car Allowances

Car Allowance Exemption Youtube

Car Allowance Exemption Youtube

What Makes Fuel Allowance One Of The Most Relevant Employee Tax Benefits

What Makes Fuel Allowance One Of The Most Relevant Employee Tax Benefits

2021 Everything You Need To Know About Car Allowances

2021 Everything You Need To Know About Car Allowances

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Allowance Vs Cent Per Mile Reimbursement Which Is Better For Employees

Allowance Vs Cent Per Mile Reimbursement Which Is Better For Employees

Car Allowance Vs Mileage Allowance For Uk Employees

Car Allowance Vs Mileage Allowance For Uk Employees

Should You Take A Company Car Or A Car Allowance

Should You Take A Company Car Or A Car Allowance

Car Allowance In Australia The Complete Guide Easi

Car Allowance In Australia The Complete Guide Easi

2021 Everything You Need To Know About Car Allowances

2021 Everything You Need To Know About Car Allowances

Comments

Post a Comment