Citibank Interest Checking Account

Meet the tiered deposit amount below to receive your APY rate. Free Citibank ATM Debit card with your dollar account.

Citibank Review Smartasset Com

Citibank Review Smartasset Com

Below youll find the current interest rates youll earn for various Citibank accounts.

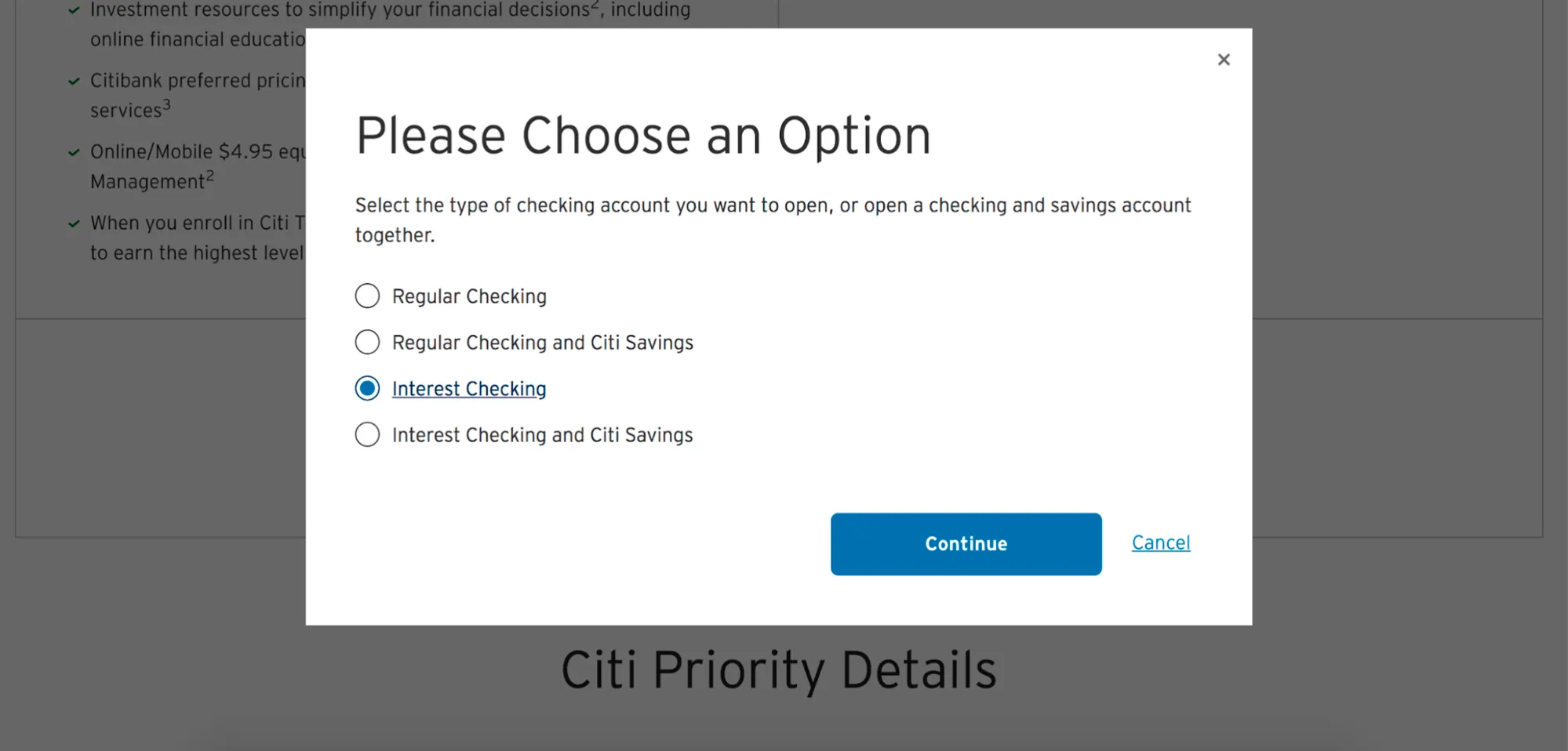

Citibank interest checking account. Open a Citibank High-Yield Interest Checking account as part of the Citi Elevate package. Attractive interest rates for deposits with balances above RM10000. Select Interest Checking or Interest Checking.

Scroll down and click Apply Now. Issue checks more easily. Were surprised Citibank still has Fees Charges on international purchases.

From the Citi website click Banking. Earn daily interest that is credited monthly into your account. Also it is 212 lower than the highest rate 215 Updated Apr 2020.

Customers residing outside of the banks. More on your savings. These interest rates apply to accounts opened online in a branch or by calling 1-800-374-9500.

With a 003 APY this is the only Citibank interest-earning checking account. Plus earn up to 25 pa. Citibanks Interest Rates arent the highest.

Does Citibank Interest Checking charge overdraft fees. This account charges a monthly service fee of up to 15. Scroll down to your desired package and click See Details.

What fees does Citibank Interest Checking charge. Citibank InterestPlus Savings Account Get the most out of your spend protect your loved ones and grow your wealth. To earn the highest rate at 07 youll need to open Citi Elevate with the Citi Accelerate Savings account.

New York Citibank announced today that it is introducing Citi Elevate Checking a digital high-yield checking account that offers unlimited ATM reimbursements nationwide while paying interest up to 1 for US. Typically checking accounts offer little or no interest on the money in your account and may charge a minimal fee for managing the account. Individual Checking Account is available in USD.

There is no minimum monthly. Otherwise youll earn up to 040 APY with the Citi Interest Checking account if you keep more than 25000 in your account. 4 rijen Interest Rates gross per annum Citi Peso Everyday Banking.

Check rates at online-only banks first. The interest-bearing Citibank CheckLink Savings Account is a class above conventional current accounts. Go to the providers site and follow the steps to apply.

If youve already opened your account you can easily check the rate by viewing your statement. Earn interest with your checking account. The rate of 003 is 061 lower than the average 064.

Interest on your Citibank US CitiAccess Account is calculated daily and credited monthly. Luckily there is no minimum opening deposit for any Citibank checking account so you can open up any account with however much youd like. Make payments by check anytime and save yourself the hassles of settling by cash.

Not available in all areas. 24x7 access to your funds worldwide via ATM internet and phone. The standout account here is the Citigold Interest Checking.

Citi Peso Bonus. Personalized Citibank check book. The Citi Interest Checking account earns 001 APY on all account balances and earns rewards in the form of gift cards discounts and travel points.

The Basic Banking Account is the lowest-tiered account offered by Citibank that comes with check-writing capabilities. Meet the tiered deposit amount below to receive your APY rate. Make swift and hassle-free payments.

Earn daily interest at competitive rates on your USD bank checking account. Youll need a Citi Interest Checking or Citi Accelerate Savings account to open Citi Elevate. Complimentary cash withdrawals from Citibank ATMs overseas with no processing fee instant fund transfers and more.

To waive the 15 monthly service fee maintain an average monthly balance of 5000 in your checking account. Open a Citibank High-Yield Interest Checking account as part of the Citi Elevate package. This account may require a minimum balance to avoid paying a monthly fee or non-Citibank ATM fees.

Citibank Interest Checking requires a minimum initial deposit of 1 to open an account. Others may waive fees if you keep a minimum balance in the account or have another account or credit card at the same bank. To waive the 15 monthly service fee maintain an average monthly balance of 5000 in your checking account.

When it comes to Products Services Citibank likely has whatever youre looking forHowever checking and savings accounts are lumped into combination packages which you might not want. How do I open The Citibank Account Interest Checking account. This checking account interest rate indicated applies to the Citibank Account.

You can open the Citi Interest Checking account online by phone or at a branch. Transfer funds in an instant between Citibank accounts across multiple countries via Citibank Global Transfer.

Citibank Account Package Review 2021 1 Update 300 Offer Us Credit Card Guide

Citibank Account Package Review 2021 1 Update 300 Offer Us Credit Card Guide

Citibank Premium Checking Account Non Citigold

Citibank Premium Checking Account Non Citigold

Citi Interest Checking Review 700 Bonus May 2021 Finder Com

Citi Interest Checking Review 700 Bonus May 2021 Finder Com

Citi Interest Checking Review 700 Bonus May 2021 Finder Com

Citi Interest Checking Review 700 Bonus May 2021 Finder Com

Earn 40 000 Aadvantage Miles For Opening A Citi Bank Account

Earn 40 000 Aadvantage Miles For Opening A Citi Bank Account

Citibank Basic Banking Checking Account 2021 Review Should You Open Mybanktracker

Citibank Basic Banking Checking Account 2021 Review Should You Open Mybanktracker

Citi 300 400 700 1 500 Personal Checking Savings Bonus Available Nationwide Direct Deposit Not Required Doctor Of Credit

Citi 300 400 700 1 500 Personal Checking Savings Bonus Available Nationwide Direct Deposit Not Required Doctor Of Credit

Onjuno Citibank Checking And Savings Account Fees 2021

Onjuno Citibank Checking And Savings Account Fees 2021

Citi 300 400 700 1 500 Personal Checking Savings Bonus Available Nationwide Direct Deposit Not Required Doctor Of Credit

Citi 300 400 700 1 500 Personal Checking Savings Bonus Available Nationwide Direct Deposit Not Required Doctor Of Credit

How To Open A Citibank Account Gobankingrates

How To Open A Citibank Account Gobankingrates

My Experience With The Citibank E Savings Account

My Experience With The Citibank E Savings Account

Citibank Savings Bonus Up To 1 500 Bankrate

Citibank Savings Bonus Up To 1 500 Bankrate

Us Citiaccess Account International Us Bank Checking Account In Singapore Citibank Ipb

Us Citiaccess Account International Us Bank Checking Account In Singapore Citibank Ipb

Comments

Post a Comment