Self Employed Income Calculator

All you need to do is enter the amount you get paid and what you spend on business costs. The deadline is January 31st of the following year.

Self Employed Calculate Your Quarterly Estimated Income Tax Xendoo

Allowable addbacks include depreciation depletion and other noncash expenses as identified above.

Self employed income calculator. This worksheet derives only the self-employed income by analyzing Schedule C F K-1 E and 2106. CalcXMLs Self Employment Tax Calculator will help you determine what your self employment tax will be. The income used for qualifying purposes is 80000 83000 163000 then divided by 24 6791 per month.

Our calculator uses standard Tax and NI calculations. If you are self employed use this simplified Self Employed Tax Calculator to work out your tax and National Insurance liability. They provide suggested guidance only and do not replace Fannie Mae or Freddie Mac instructions or applicable guidelines.

As business owners the goal for self-employed borrowers is to maximize income yet reduce tax liability. Employed and Self Employed uses tax information from the tax year 2021 2022 to show you take-home pay. See what happens when you are both employed and self employed at the same time - with UK income tax National Insurance student loan and pension deductions.

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Capital Gains and W-2 income should also be analyzed separately. The calculator uses tax information from the tax year 2021 2022 to show you take-home pay.

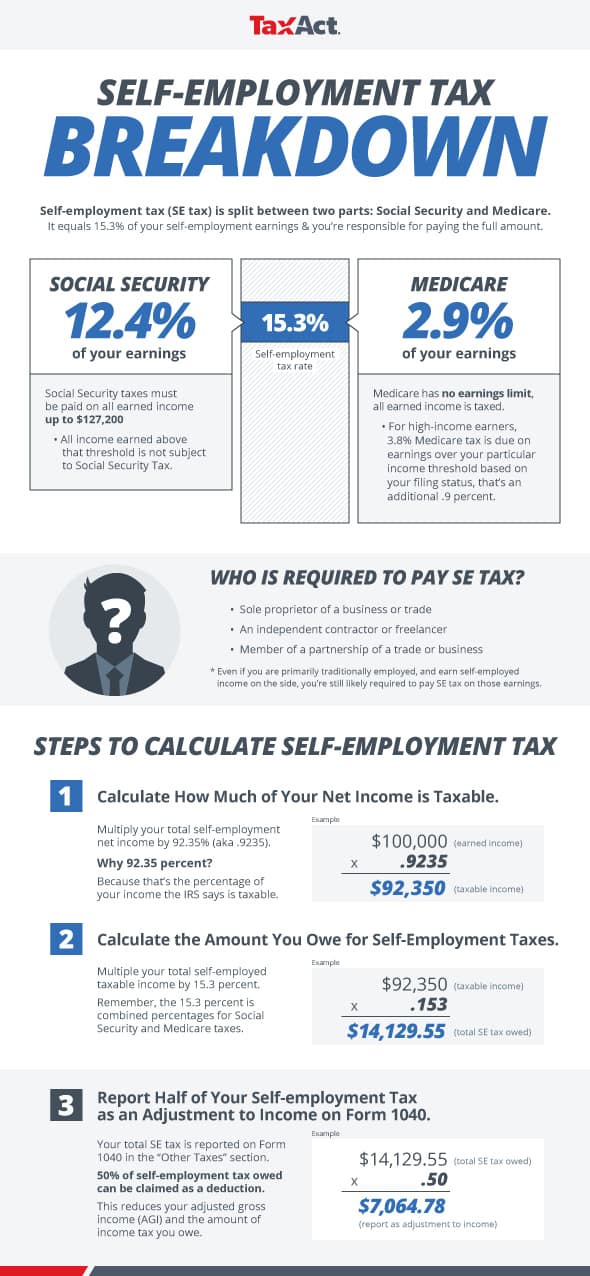

More information about the calculations performed is available on the details page. Calculating your tax starts by calculating your net earnings from self-employment for the year. Self Employment Tax Calculator Small business owners contractors freelancers gig workers and others whose net profit is greater than 400 are required to pay self-employment tax.

This percentage is a. For example say year one the business income is 80000 and year two 83000. Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more.

For tax purposes net earnings usually are your gross. A typical profit and loss statement has a format similar to IRS Form 1040 Schedule C. Well then work out your Tax and NI figures for you.

Can be used by salary earners self-employed or independent contractors. UK Self Employed Tax Calculator Use this simple calculator to quickly calculate the tax and other deductions that are taken from income from self employment. Pays for itself TurboTax Self-Employed.

Self-Employed Borrower Tools We offer a valuable collection of downloadable calculators and reference guides to help you with calculating and analyzing the average monthly income of self-employed borrowers. Our cash flow analysis worksheets help you to easily and accurately determine a self-employed borrowers income. Self-employed workers are taxed at 153 of the net profit.

Radians Self-Employed Cash Flow Analysis Calculator is designed to assist you in underwriting loan applications from self-employed borrowers for coverage with Radian mortgage insurance. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you. Use our calculator to confirm your PPP eligibilty and amount.

The calculator takes your gross income and then reduces it. You pay 7200 40 on your self-employment income between 10000 and 28000. The problem with that is reducing tax liabilities minimizes taxable income and makes qualifying for a loan more challenging.

More information about the calculations performed is available on the details page. In the simplest one say you make 30000 from self-employment income and have no other work. You will need to submit a Self Assessment tax return and pay these taxes and contributions yourself.

Selfemployed borrowers business only to support its determination of the stability or continuance of the borrowers income. Non-business income such as dividends interest and rental income should be summarized separately on the loan application. More guidance available at our PPP Resource Center.

Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax. You pay 2000 20 on your self-employment income between 0 and 10000. They calculate your income by adding it up and dividing by 24 months.

Our self-employed and sole trader income calculator is easy to use. Keep Your Career On The Right Track Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. PPP Eligibility Calculator for Self Employed1099 Self-employed and 1099 workers.

This calculator gets you a full breakdown of the deductions on your profits with minimum inputs required. The calculator also tells you if you can get PPP a second time.

Self Employment Income Mortgagemark Com

Self Employment Income Mortgagemark Com

Self Employment Calculator Youtube

Self Employment Calculator Youtube

Calculating Your Tax With Self Employment Tax Calculator Is Safe Providing Details Is Just What People Need To Do Every Self Employment Employment Income Tax

Calculating Your Tax With Self Employment Tax Calculator Is Safe Providing Details Is Just What People Need To Do Every Self Employment Employment Income Tax

:strip_icc()/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-e59e69ce6941454cb1025178eab3574d.png) How Much Should You Budget For Taxes As A Freelancer

How Much Should You Budget For Taxes As A Freelancer

Https New Content Mortgageinsurance Genworth Com Documents Training Course Review 20s Corporation 20tax 20return 20form 201120s 20and 201040 20with 20w2 20and 20k1 Pdf

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Self Employed Tax Calculator Self Employment Success Business Financial Management

Self Employed Tax Calculator Self Employment Success Business Financial Management

How To Set Your Own Salary Small Business Owner Salary Calculator Gusto

How To Set Your Own Salary Small Business Owner Salary Calculator Gusto

Schedule C Income Mortgagemark Com

Schedule C Income Mortgagemark Com

How Self Employment Is Tax Calculated Taxact Blog

How Self Employment Is Tax Calculated Taxact Blog

Freelance Target Income Calculator By Paul Millerd Reimagine Work Medium

How Can A Self Employed Person Calculate The Net Income Is There Any Formula We Can Refer To Parents In Quebec Babycenter Canada

How Can A Self Employed Person Calculate The Net Income Is There Any Formula We Can Refer To Parents In Quebec Babycenter Canada

How To Calculate Self Employment Tax Four Pillar Freedom

How To Calculate Self Employment Tax Four Pillar Freedom

Comments

Post a Comment