Sofi Business Loans

These include private student loans personal loans as well as home loans. 4 meet SoFis underwriting criteria.

Sofi Business Model Canvas Business Model Canvas Business Model Canvas Examples Online Business Models

Sofi Business Model Canvas Business Model Canvas Business Model Canvas Examples Online Business Models

The loans are designed to cover eight weeks of expenses.

Sofi business loans. This business is not BBB Accredited A. SoFi doesnt offer small business loans directly. Currently its focused on helping businesses that have been hurt by COVID-19.

OnDeck Small Business Loan Terms Rates and Fees Loan amounts. Licensed by the Department of Business Oversight under the California Financing Law License No. And 5 take out a loan.

Lines of credit from 6000 to 100000 APR range. 1 register and apply for a SoFi Personal Loan before 1159pm ET 612021. One option for new businesses is the SBA Microloan program which lets you borrow up to 50000.

Licensed by the Department of Business Oversight under the California Financing Law License No. It cannot guarantee profit or fully protect against loss in a declining market. Its products can be categorized into 5 distinct categories namely Borrow Invest Spend Protect and For Business.

Customer Reviews are not used in the. Business Details Location of This Business 2750 E Cottonwood Pkwy Ste 300 Holladay Cottonwood UT 84121-7285. BBB Rating Accreditation.

Updated as of 492021. The lenders are primarily banks and credit unions both big and small. A decade ago SoFi started out as a student loan refinancing business.

SoFi loans are originated by SoFi Lending Corp. Licensed by the Department of Business Oversight under the California Financing Law License No. The closest thing it has to business financing.

Since then its unveiled a comprehensive series of financial products to the extent that most of your financial life could. It cannot guarantee profit or fully protect against loss in a declining market. Why doesnt SoFi offer business loans.

It cannot guarantee profit or fully protect against loss in a declining market. Lines of credit run from 1099 to 619 APR. It could be because SoFis focus is on helping individuals become financially independent.

SoFi loans are originated by SoFi Lending Corp NMLS 1121636. Just like most other business. Loans can either be issued or re-financed.

Until recently SoFi only offered student loan products with an emphasis on refinancing for young professionals. If you find yourself wondering how much money your business might need in order to get to the next level you may want to begin by taking a thorough look at the needs of the business you are trying to grow. 3 have or apply for a SoFi Money account within 30 days of checking your rate to receive the bonus.

Once conditions are met and the loan has been disbursed your welcome bonus will be deposited into your SoFi Money. This company offers student loan refinancing mortgages and personal loans. On the Borrow side SoFi offers a breadth of loans available to consumers.

Short-term loans range from 35 to 983 APR. San Francisco CA 94105. To receive the 250 offer you must.

2 complete a loan application with SoFi within 14 days. Licensed by the Department of Financial Protection and Innovation under the California Financing Law License No. The loans are 100 backed by the SBA.

SoFi short for Social Finance is a FinTech company that offers a variety of personal finance products to American consumers and businesses. In a few instances SoFi. The average line of credit rate is 4806 APR.

SoFi refinance loans are private loans and do not have the same repayment options that the federal loan program offers or may become available such as Income Based Repayment or Income Contingent Repayment or PAYE. SoFi loans are originated by SoFi Lending Corp NMLS 1121636. But it launched a platform called SoFi Lantern to help connect business owners with funding.

Its run through lenders that are part of the Small Business Administration SBAs 7 a loan program which provides financial support to eligible small businesses. SoFi refinance loans are private loans and do not have the same repayment options that the federal loan program offers or may become available such as Income Based Repayment or Income Contingent Repayment or PAYE. It only started providing personal financing products and hasnt expanded into business loans just yet.

In 2018 the average Small Business Administration SBA loan from the 7 a loan program was for 417316. Some lenders require a minimum personal credit score of just 545 although you may find some requiring at least 620 to 640. Licensed by the Department of Financial Protection and Innovation under the California Financing Law License No.

SoFi loans are originated by SoFi Lending. SoFi loans are originated by SoFi Lending Corp NMLS 1121636.

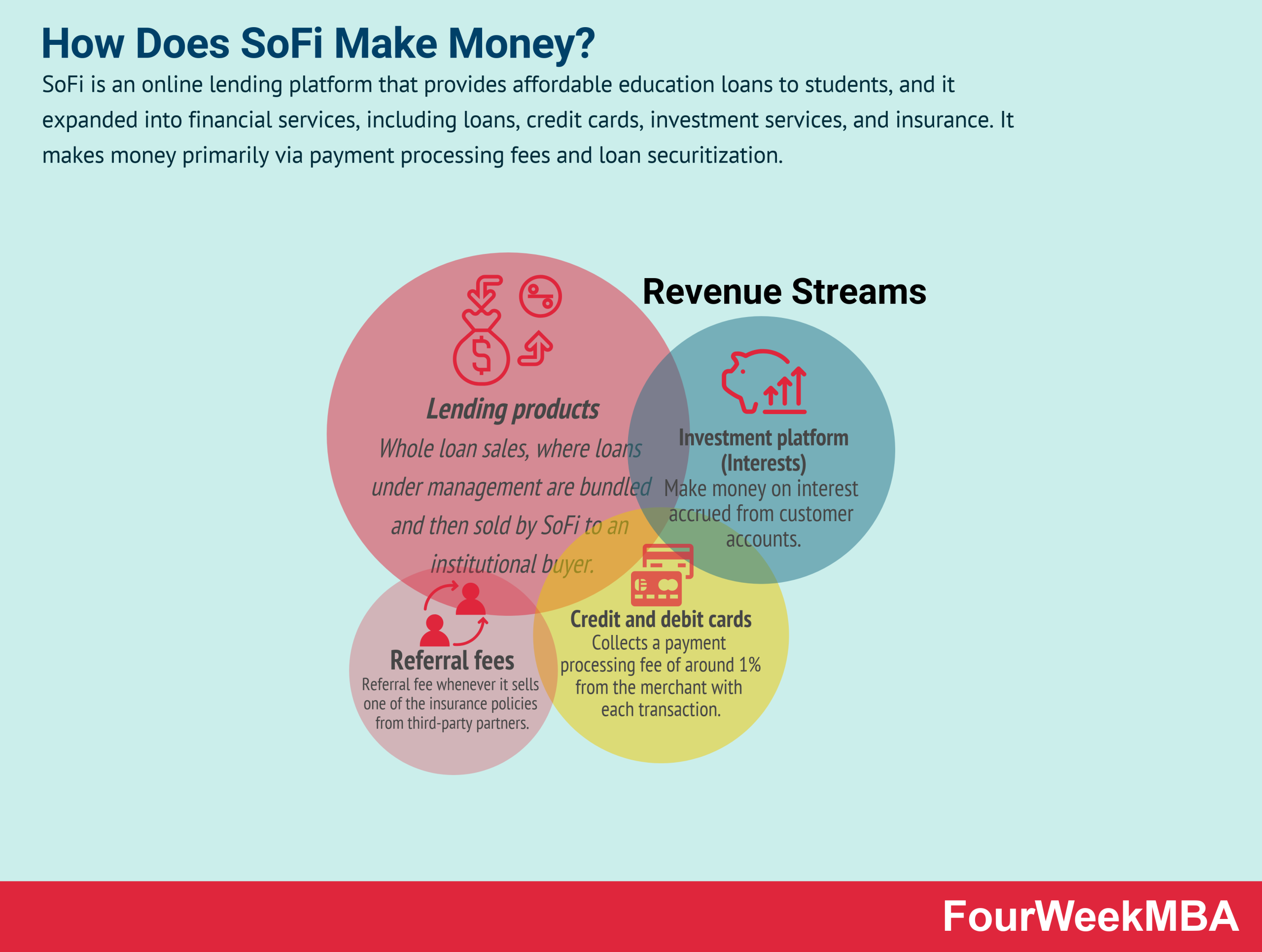

Great Rates Great Benefits Sofi

Great Rates Great Benefits Sofi

Sofi Review Learn How To Apply For Social Finance Loans Online

Fintech Business Model Spotlight Sofi Cb Insights Research

Fintech Business Model Spotlight Sofi Cb Insights Research

Sofi Business And Revenue Model How It Works

Sofi Business And Revenue Model How It Works

Great Rates Great Benefits Sofi

Great Rates Great Benefits Sofi

Sofi A Finance Company That S On Your Side

Sofi A Finance Company That S On Your Side

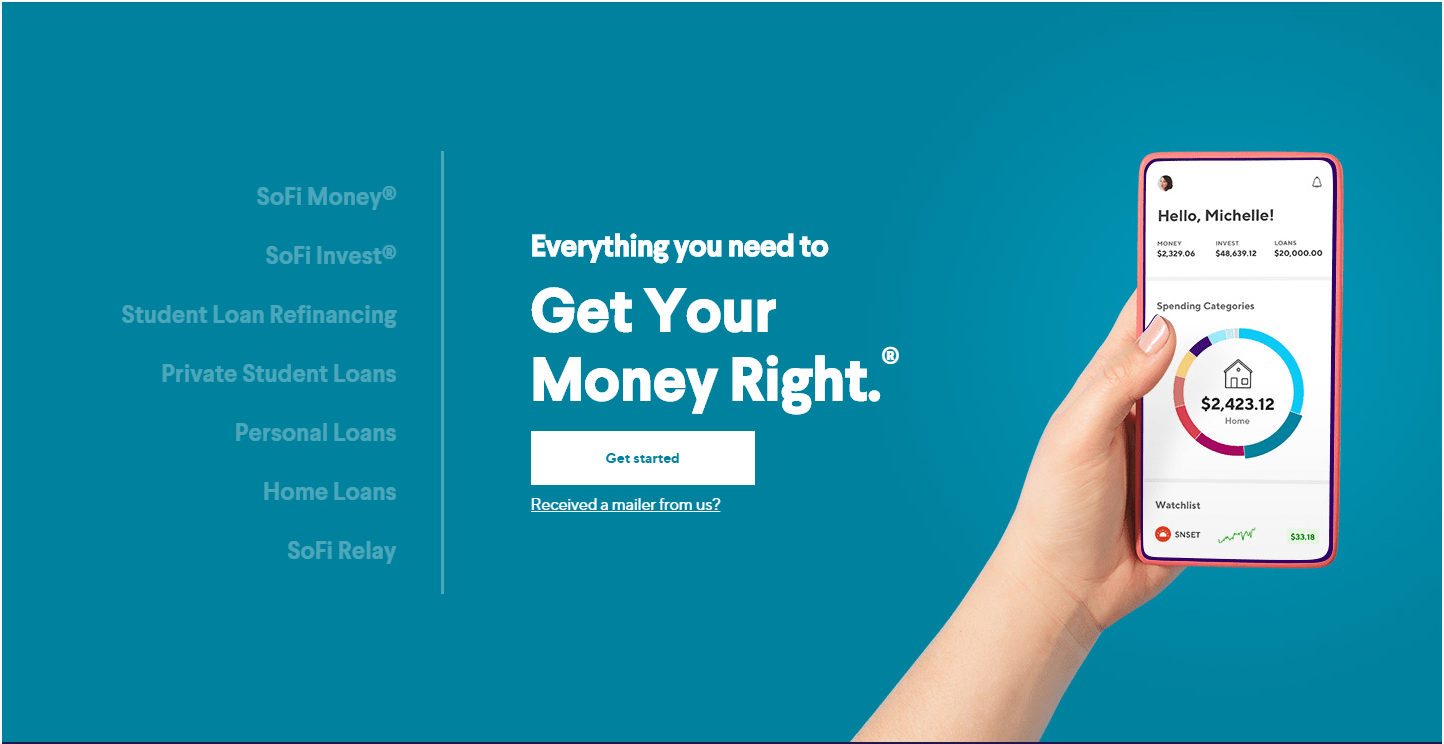

How Does Sofi Make Money Fourweekmba

How Does Sofi Make Money Fourweekmba

Sofi Personal Loans Review May 2021 Finder Com

Sofi Personal Loans Review May 2021 Finder Com

Sofi Business And Revenue Model How It Works

Sofi Business And Revenue Model How It Works

How Sofi Rose To Become An Alternative Finance Leader Lending Times

How Sofi Rose To Become An Alternative Finance Leader Lending Times

Sofi Review 2021 The One Financial Platform For Every Millennial

Sofi Review 2021 The One Financial Platform For Every Millennial

Sofi Review Loans Refinancing Investments And Insurance Yes

Sofi Review Loans Refinancing Investments And Insurance Yes

Comments

Post a Comment