Chase Business Banking Requirements

To qualify you must open a Chase Business Complete Banking SM account deposit a minimum of 2000 within 30 business days maintain at least that balance for 60 days and perform at least 5 qualifying activities in the first 90 days. Chase Business Opening Requirements.

Chase Launches Business Complete Banking With All The Essentials Built In Business Wire

Chase Launches Business Complete Banking With All The Essentials Built In Business Wire

We work with individual customers small businesses corporations financial institutions non-profits and governments.

Chase business banking requirements. This account comes with many benefits. Discover your personal potential and your professional possibilities. 1 Maintain a minimum daily balance of at least 2000 in your account as of the beginning of each day of the statement period 2 Spend at least 2000 in purchases minus returns or refunds using your Chase Ink Business Cards that shares a business legal name with the Chase Business.

No minimum deposit to open New or cash-strapped businesses will appreciate being able to open a Chase Business Complete BankingSM with 0 to start. The following information is required to open the account. Be a new Chase business checking customer Deposit 2000 or more total of new money within the first 30 days of coupon enrollment Maintain at least a 2000 minimum balance for 60 business days.

Other banks will require a minimum deposit of 1000 or more. Chase business checking account requirements vary based on the type of business you have. Chase offers business banking services and products for your needs Business Checking Chase offers a wide variety of business checking accounts for small mid-sized and large businesses.

The first type of business is a s sole proprietorship. Requirements for Opening a Chase Business Checking Account. Chase is one of the most popular business checking account options for small businesses but even Chase.

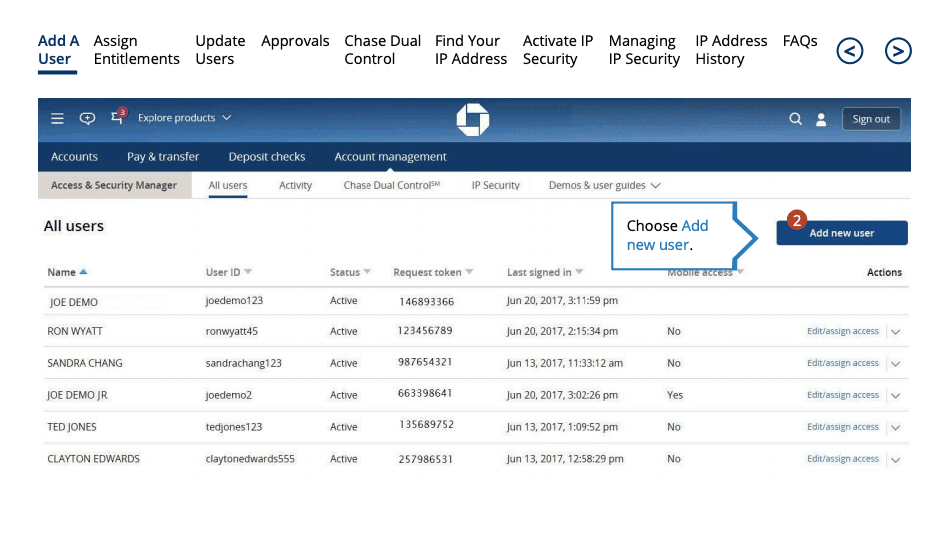

Two forms of ID are required and one must be a government issued ID. For instance youll get 100 free transactions each month unlimited electronic deposits and no. Qualifying activities include transactions such as debit card purchases Chase Quick Deposit wire transfers ACH transfers ACH Credits and wires Credits.

Having an idea of what account to open and what you plan to utilize it for may be to your benefit in a long run and what better way then to get started with Chase. 300 signup bonus when you open a new Chase Business Complete Banking account with qualifying activities Offer valid for Chase business checking accounts through July 23 2021 when you deposit 2000 within 30 days of opening your account maintain 2000 for 60 days and complete five transactions within 90 days. The minimum deposit amount is 25.

How much do I need to deposit to open up a Chase business bank account. Additionally pay attention to which type of documents you need to provide for your specific type of business. Footnote link 1 Chase Business Complete Checking has a 15 Monthly Service Fee unless you fulfill at least one of the following qualifying activities.

Opening a Chase Bank Account is a simple process as long as you have the documents required to open one. Chase Business Complete Checking account. As of 2018 douple dipping applications no longer work.

The scale of our business provides you with amazing career opportunities. Form of Identification Tax Identification Number Business Documentation Assumed Name Certificate. Choosing a business bank account can feel overwhelming and all the fine details can sometimes be hard to find and compare thats why weve written this review of Chase Business Complete Checking to help make it easier for you to choose a home for your business finances.

You can make this deposit with cash or send money from your bank account via QuickPay with Zelle. Compare our business checking solutions chart to select exactly which checking account is right for you. Chase requires the Secretary to be present to open a new account.

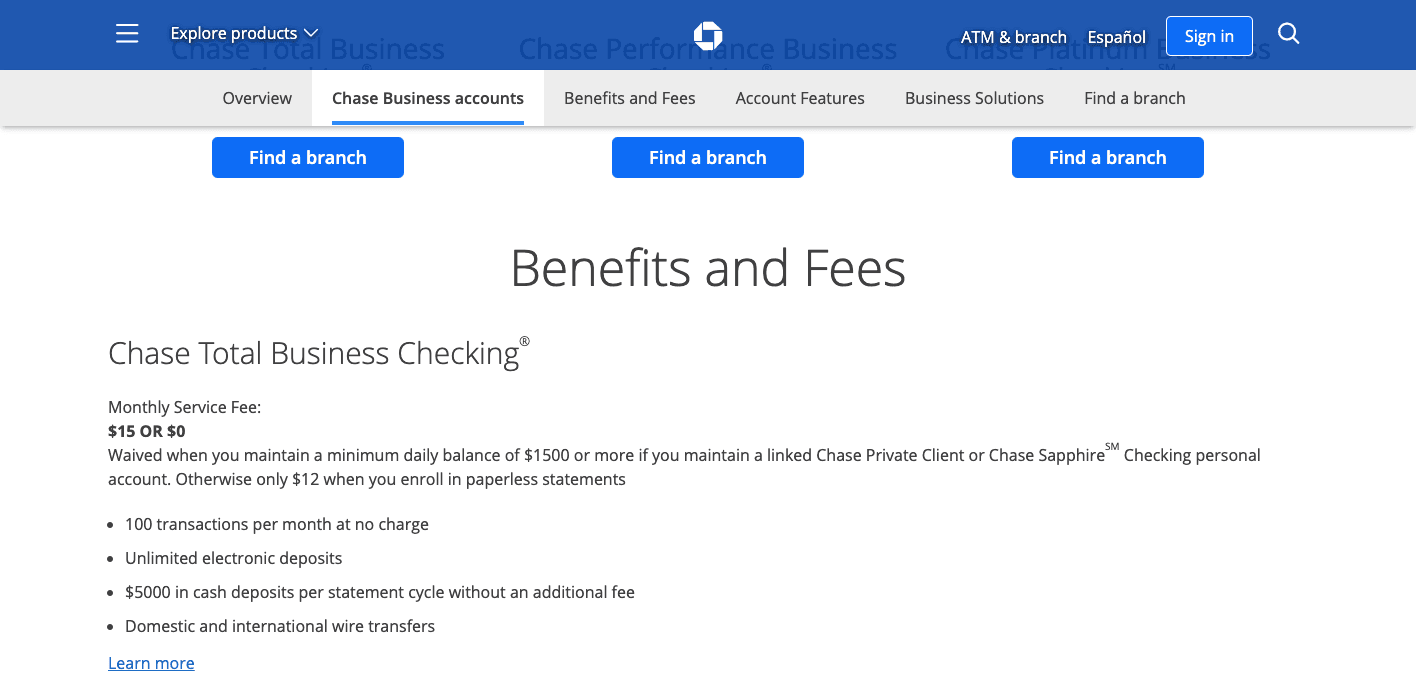

Chase offers different business checking accounts. Chase offers a wide variety of business checking accounts for small mid-sized and large businesses. Chase Performance Business Checking comes with a 30 Monthly Service Fee that can be waived by maintaining an average beginning day balance of 35000 or more in linked business savings CDs and other Chase Performance Business Checking accounts excluding client funds savings accounts.

This account is geared towards smaller and newer businessesFees include. Chase is a solid choice for small businesses because it offers the kind of features these business owners need. Its a lot easier and less risky for Chase to give you a credit line of 1000 with the Chase Freedom as opposed to the minimum 10000 credit limit with the Chase Sapphire Reserve.

Chase doesnt publish its small-business loan application criteria again you have to visit your branch to find out but if its anything like other big banks youll need a good credit score at least a couple years in business and revenue of at least 200000. Chase usually looks for a great credit score or a banking relationship. To qualify for the 300 Chase business checking bonus you must.

Chase Business Complete Banking Chase Performance Business Checking and Chase Platinum Business Checking. Before you can open a Chase Business Account you have to provide documents providing proof of your business.

Chase Business Debit A Bank Deal Guy

Chase Business Debit A Bank Deal Guy

Chase Business Complete Banking Sm Chase For Business Chase Com

Chase Business Complete Banking Sm Chase For Business Chase Com

Chase Business Complete Banking Sm Chase For Business Chase Com

Chase Business Complete Banking Sm Chase For Business Chase Com

Chase Business Checking Review A Great Fit For Small Businesses

Chase Business Checking Review A Great Fit For Small Businesses

Chase Business Banking Overview

Chase Business Banking Overview

Dead Chase Business Performance Checking 500 In Branch Bonus No Direct Deposit Required Doctor Of Credit

Dead Chase Business Performance Checking 500 In Branch Bonus No Direct Deposit Required Doctor Of Credit

Chase Coupon 300 Business Bonus Working Link No Direct Deposit

Chase Business Checking Review A Great Fit For Small Businesses

Chase Business Checking Review A Great Fit For Small Businesses

Chase Business Complete Checking 300 Bonus No Direct Deposit Required Available Online Doctor Of Credit

Chase Business Complete Checking 300 Bonus No Direct Deposit Required Available Online Doctor Of Credit

Chase Total Business Checking Huge 500 Bonus Available Miles To Memories

Chase Total Business Checking Huge 500 Bonus Available Miles To Memories

Chase Business Complete Banking Sm Chase For Business Chase Com

Chase Business Complete Banking Sm Chase For Business Chase Com

3 Chase Business Checking Accounts In 2021 300 Bonus

3 Chase Business Checking Accounts In 2021 300 Bonus

Chase Business Checking Accounts Requirements Documents Needed 2020 Uponarriving

Chase Business Checking Accounts Requirements Documents Needed 2020 Uponarriving

Chase Ink Business Preferred Credit Card Chase Com

Chase Ink Business Preferred Credit Card Chase Com

Comments

Post a Comment